October 7, 2014

Click HERE to Download a FREE Sample of the ValuEngine View NewsletterVALUATION WATCH IS OFF: Overvalued stocks now make up 51% of our stocks assigned a valuation and 14.66% of those equities are calculated to be overvalued by 20% or more. Eleven sectors are calculated to be overvalued. Is Smaller Really Better?--Tech Giant Hewlett-Packard Announces Split of Company Hewlett Packard (HPQ) is one of the leading global providers of computing and imaging solutions and services for business and home. The company is focused on capitalizing on the opportunities of the Internet and the proliferation of electronic services. Its major businesses include Imaging and Printing Systems, Computing Systems and Information Technology Services. In effort to improve its competitive position, the company announced yesterday that it would split itself into two entities. One side, HP Incorporated, will focus on the current HP's computer and printer operations. The other side, to be known as Hewlett-Packard Enterprise, will focus on services sold to large enterprises such as software, consulting, storage, and servers. The issue doesn't seem to be the printers and such, the enterprise portion of the business is what seems to be holding the company back--of course, one can recall a few real issues on that consumer side--HP touchpad tablet debacle? Anyone? Anyone? CEO Meg Whitman voiced the usual justifications for executives searching for solutions via such plans: the move will make the company "nimble," more able to recognize and exploit opportunities, etc. But, as the Wall Street Journal notes today, Whitman's new enterprise company will be cut off from the ample resources the computer and printer business currently provides. How does one exploit opportunities and buy up promising new technology, talent, and ideas if one is strapped for ready cash when some big tech players are sitting on billions? So far, the market has blessed the move. HP shares jumped almost 5% on the news of the split in yesterday's trading. Meanwhile, ValuEngine continues its HOLD recommendation on Hewlett Packard for 2014-10-06. Based on the information we have gathered and our resulting research, we feel that Hewlett Packard has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Earnings Growth Rate. Below is today's data on HPQ:

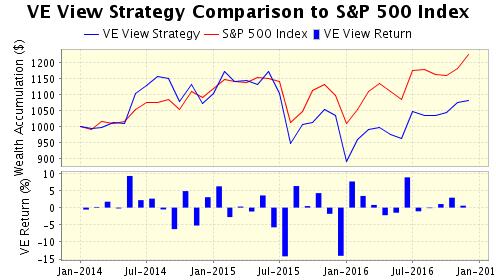

For July/August, the ValuEngine View worked its way to a decent gain of 2.62% vs a flat S&P500 return. The trailing 12 month gain of the VE View is 36% versus the S&P 500 return of 19.93%. The return since inception of the View is 130% versus the S&P's gain of 75%. While ValuEngine offers numerous ready-to-trade portfolios and newsletters designed for every risk/reward profile and every investment style, the View is our best performing newsletter under current market conditions.

The View features the absolute top quality picks from our extensively tracked and tested quant models. It is the only newsletter which features picks from both the ValuEngine Stock Valuation and Forecast Model. With the View, investors can utilize the power of ValuEngine to achieve their goals in a steady and consistent manner.

With the ValuEngine View Newsletter you Receive 20 Carefully Selected Stock Picks

We had six winners this month—most of them in double-digit territory. Despite some early wobbles, Canadian Solar led the way with a nice 20% pick up followed closely by E-House China with a pick up of 18.63%. We also garnered good returns from Soufun, Huntington Ingalls, and Aercap Holdings. Here are the latest results from June/July 2014:

Our Investment Strategies Focus on Dozens of Fundamental and Technical Factors for over 7,000 Individual Stocks, Synthesize the Data, and then Come Up with a Portfolio Looking for a monthly portfolio of stock picks which are objective and based on cutting-edge academic theory and Wall St.practice? Then subscribe to The ValuEngine View Newsletter.The ValuEngine View Portfolio is based on our highly-refined and tested ValuEngine Portfolio Strategies along with our proprietary quant-based composite scoring system. The ValuEngine View Newsletter is the product of sophisticated stock valuation and forecast models first developed by Yale Professor of Finance Zhiwu Chen.

The ValuEngine View Newsletter is derived from the ValuEngine Aggressive and Diversified Growth Benchmark CLICK HERE to Subscribe to the ValuEngine View The ValuEngine View Newsletter portfolio has 15 primary stock picks and five alternates and is re-balanced once each month. The ValuEngine View Newsletter is published near the middle of each calendar month. An equal amount of capital is allocated to each stock. The monthly returns are calculated from the closing prices on date of publication. The performance calculation does not include any transaction costs.

ValuEngine Market Overview

ValuEngine Sector Overview

ValuEngine.com Products and Services

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||