October 21, 2014

Click HERE to Download a FREE Sample of the ValuEngine View NewsletterVALUATION WATCH IS OFF: Undervalued stocks now make up 54.32% of our stocks assigned a valuation and 18.5% of those equities are calculated to be undervalued by 20% or more. Seven sectors are calculated to be undervalued--two by double digits. Not So Golden--McDonald's Profit Plunges 30% McDonald's Corporation (MCD) develops, operates, franchises and services a worldwide system of restaurants that prepare, assemble, package and sell a limited menu of value-priced foods. The company operates primarily in the quick-service hamburger restaurant business. All restaurants are operated by the company or, under the terms of franchise arrangements, by franchisees who are independent third parties, or by affiliates operating under joint-venture agreements between the company and local business people. McDonald's reported Q3 earnings today and it would be an understatement to say they were "not good." According to the Wall Street Journal, profits fell @ $0.43/share. This was the worst performance for the company in seven years. The company was hit with a tax charge of $0.26/share and if that charge is excluded, the company posted the worst decline in earnings since 2002. overall revenues were down five percent and the company missed estimates by $0.28/share. The company is struggling to compete in today's marketplace, and has been unable to attract younger diners--who are more attracted to--supposedly-- healthier, "fast casual" alternatives such as Chipotle, Panera, etc. Moving forward, we would expect some chages to both our forecast and valuation figures as our models digest changes in price as well as earnings estimates. For now, ValuEngine continues its HOLD recommendation on MCDONALDS CORP for 2014-10-20. Based on the information we have gathered and our resulting research, we feel that MCDONALDS CORP has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Book Market Ratio. Below is today's data on MCD:

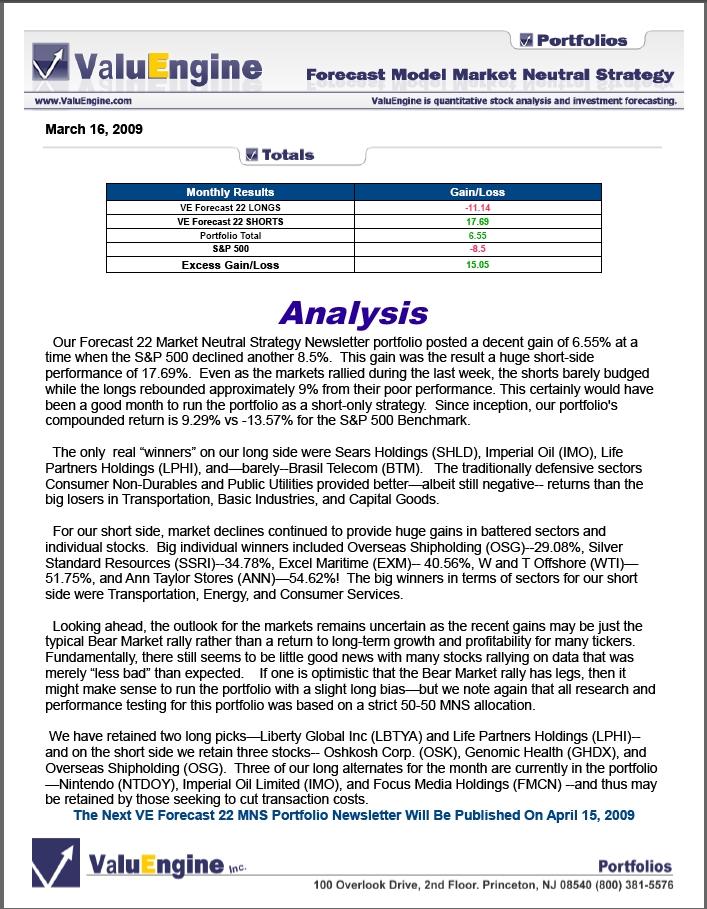

ValuEngine Market Overview

ValuEngine Sector Overview

ValuEngine.com Products and Services

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||