October 27, 2014

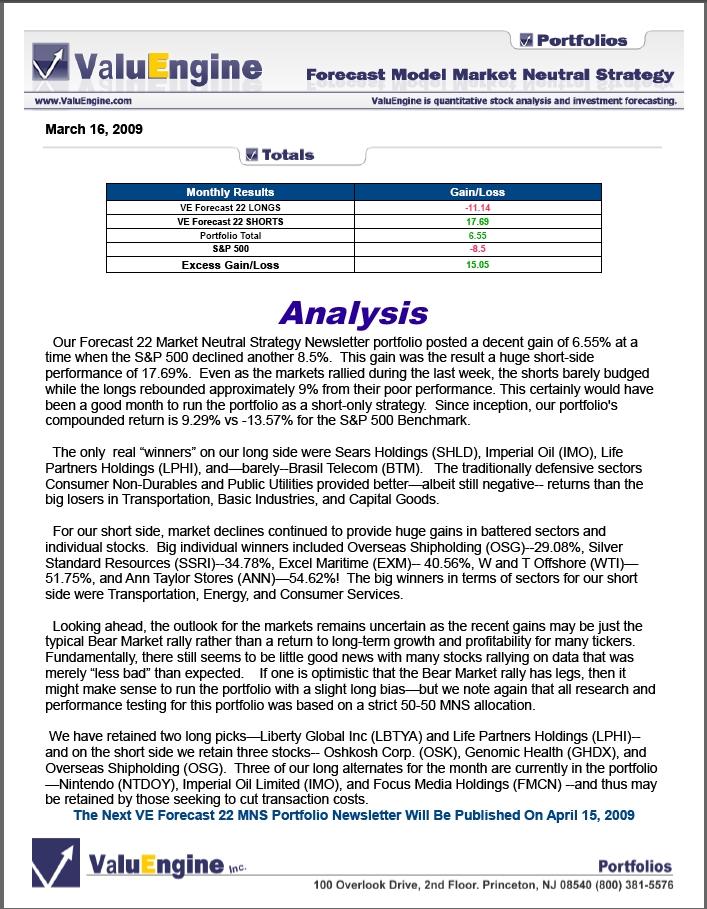

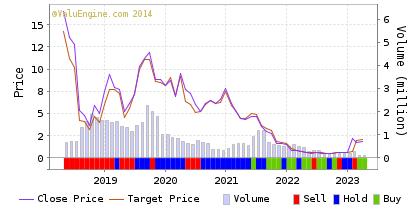

Click HERE to Download a FREE Sample of the ValuEngine View NewsletterVALUATION WATCH IS OFF: Overvalued stocks now make up 53.4% of our stocks assigned a valuation and 15.53% of those equities are calculated to be overvalued by 20% or more. Eleven sectors are calculated to be overvalued. Healthy Return--ValuEngine Long Pick Lannett Up Big for Market Neutral Newsletter Lannett, Inc. (LCI) manufactures and distributes pharmaceutical products sold under generic names and historically has manufactured and distributed pharmaceutical products sold under its trade or brand names. In addition, the Company contract manufactures and private labels pharmaceutical products for other companies. Lannett was the Medical Sector long pick for our ValuEngine Forecast 16 Market Neutral Newsletter portfolio this month. Since our latest rebalance on October 15th, the stock has surged more than 21%. The company has been projecting very impressive earnings growth this year that comes on top of some incredible actual growth last year. Analysts have been touting this company for some time, and our model captured the latest growth spurt for our subscribers. ValuEngine continues its BUY recommendation on LANNETT INC for 2014-10-24. Based on the information we have gathered and our resulting research, we feel that LANNETT INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Sharpe Ratio. Below is today's data on LCI:

Want To Know More About Our Market Neutral Newsletter? The ValuEngine Forecast 16 Market Neutral Strategy Newsletter is based on one of our most tested and researched portfolio strategies. It uses our Forecast Model to provide the same sort of long-short equity portfolio utilized by major hedge funds and institutions without the hefty management and performance fees. Why Market Neutral? Market neutral strategy (MNS) portfolios offer the potential of decent, steady returns in both good markets and bad. For the last three years, the ValuEngine Forecast 16 Model MNS portfolio has provided the highest returns of any of our benchmark portfolio strategies. The ValuEngine Diversified Growth 16 Market Neutral Strategy Newsletter offers the investor capable of running a short side access to increased performance with lower overall volatility and hedged risk.You can run an equally allocated MNS portfolio, or customize it to your needs by adjusting your capital allocation between the long and short sides. With the ValuEngine Diversified Growth 16 Market Neutral Strategy Newsletter, you can--essentially--run your own hedge fund! Each month you will receive an electronic copy of our newsletter highlighting 16 potential long and short positions along with 16 alternate picks per side. Each of our 16 sectors will include 2 stocks so that you can construct a diverse portfolio that minimizes risk and maximizes returns. We carefully examine dozens of fundamental and technical factors for over 5,500 individual stocks, synthesize the data, and then come up with a sector-diverse list of our best and worst forecast 1-month return stocks.Each portfolio pick includes critical ValuEngine valuation and forecast data. These 64 total picks represent the most up-to-date equity assessments of our proprietary models. Please click HERE to subscribe. After your subscription is approved, you will immediately receive access to download the current issue of newsletter as well as the previous issues, which are all available as PDF files. Each month when the latest issue of the newsletter is released, we will send you an email, informing you to download it from the site. The newsletter is released near the middle of each month, and each issue will inform you of the next publication date.

ValuEngine Market Overview

ValuEngine Sector Overview

ValuEngine.com Products and Services

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||