November 26, 2014

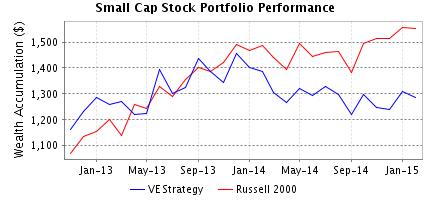

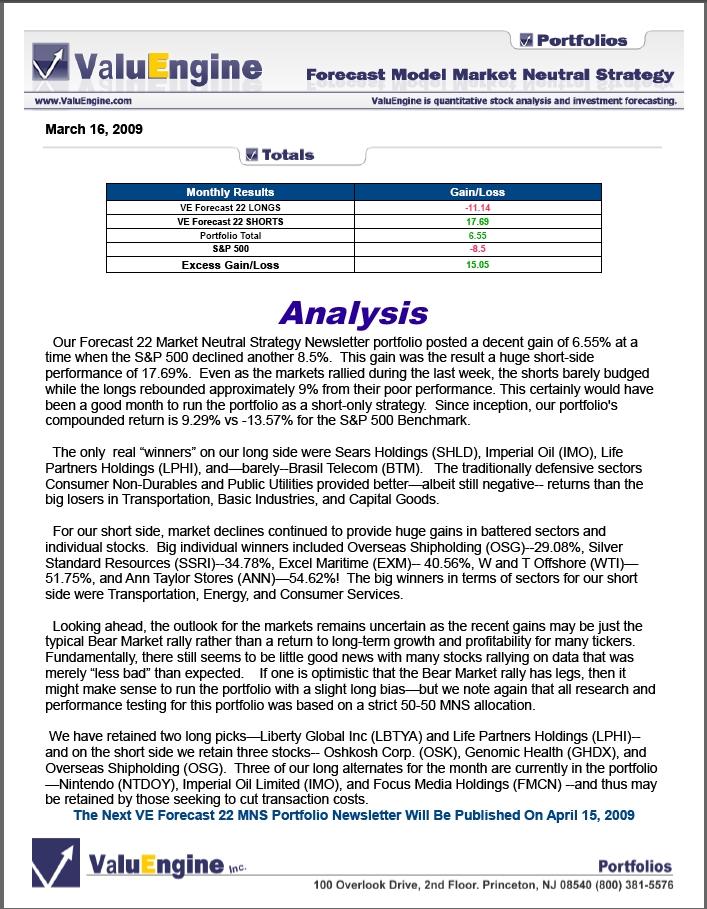

Click HERE to Download a FREE Sample of the ValuEngine Small Cap Stock NewsletterValuation WATCH: Overvalued stocks now make up 62.11% of our stocks assigned a valuation and 22.57% of those equities are calculated to be overvalued by 20% or more. Fourteen sectors are calculated to be overvalued--with seven sectors at or near double digits. ValuEngine Small Cap Stock Newsletter Posts 6% Gain--Two Picks Gain More Than 40% The ValuEngine Small Cap Stock Newsletter features 15 primary stock selection and five alternate stock picks derived from our award-winning stock forecast model. Equities selected focus on small-cap companies which can be more voaltile, but also offer the potential of outsized returns for a given amount of investment capital. For October/November, the stock market continued its renewed rally. Our small cap stock newsletter also laid in a strong gain as investors began to pick up this equity class again. We had a great gain of 6.22% overall but couldn't quite match the SP500 pick up of 7.26%. We trailed by 104 bps. The trailing 12 month gain of the Small Cap Stock Strategy is -6.47% versus the S&P 500 return of 16.04%. The return since inception is 29.58% versus the S&P's gain of 49.04%. We had nine out of 15 winners this month, with some massive pickups courtesy of Tower Semiconductors (44.66%) and Inteliquent (40.17%). We also garnered double-digit pick ups from Tower International, DTS Inc., Ultra Clean Holdings, and Pacific Ethanol. Unfortunately our few losers tended to post double-digit losses, so we were held back from truly outstanding performance by Star Bulk Carriers, Arotech, Valco Enbergy, and HCI Group. We also bemoan the fact that we had an alternate that was NOT included in the main portfolio. Ani Pharma had a huge gain of 97.57%. Currently, the Valuation Model finds that 62.11% of the equities to which we can assign a valuation are overvalued--with 22.57% coming in overvalued at 20% or more. Fourteen sectors are overvalued— seven of them by double-digit figures. We have seen fears of Ebola, ISIS, and other issues fade “magically” with the latest election. We find that the environment for equities remains positive and economic data continues to improve. Clearly, much of the doom and gloom back in mid-October had more to do with political arguments and electoral concerns than raw data. We hope that the market rally lays in new highs that small cap stocks will continue to find favor. With the ValuEngine Small Cap Stock Newsletter you Receive 20 Carefully Selected Stock Picks

Here are the latest results from October/November 2014:

Our Investment Strategies Focus on Dozens of Fundamental and Technical Factors for over 7,000 Individual Stocks, Synthesize the Data, and then Come Up with a Portfolio For the ValuEngine Small Cap Stock Newsletter, companies with a market cap greater than @ $500 million are eliminated from the selection basket. Stocks trading at less than $1.00/share are also eliminated. This typically leaves @700-1300 equities eligible for inclusion in the portfolio each month. Stock selections are further refined by applying the VE Forecast Model one-year return calculations to rank stocks according to the highest return forecasts. The final portfolio is then selected based on the one-month return forecast of the remaining stock basket. Portfolio size is limited to 15 stocks. No diversity requirements are applied. An equal amount of capital was allocated to all stocks. CLICK HERE to Subscribe to the ValuEngine Small Cap Stock Newsletter Small cap stocks allow investors to establish larger positions on a share basis and thus benefit from the price swings and upward volatility of these sorts of equities. Small cap stocks often lead rallies. However, this volatility and risk runs both ways. So, prudent investors are careful to establish stop-losses and hedging strategies for every portfolio. ValuEngine Market Overview

ValuEngine Sector Overview

ValuEngine.com Products and Services

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||