December 5, 2014

Valuation Watch: Overvalued stocks now make up 56.41% of our stocks assigned a valuation and 19.08% of those equities are calculated to be overvalued by 20% or more. Thirteen sectors are calculated to be overvalued--with six sectors at or near double digits. ValuEngine Index Overview

ValuEngine Market Overview

ValuEngine Sector Overview

ValuEngine Newsletters Latest Results

ValuEngine's Newsletters Beat the Market Let ValuEngine Optimize your Portfolio and Provide Rational Advice for Smarter Investing Click HERE to Check Out ValuEngine's Investment Newsletters Free Download for ReadersAs a bonus to our Free Weekly Newsletter subscribers, Sony Corporation develops and manufactures consumer and industrial electronic equipment. The Company's products include audio and video equipment, televisions, displays, semiconductors, electronic components, computers and computer peripherals, and telecommunication equipment. The Company is also active in the worldwide music and image-based software markets. We add Sony to our list of companies--Target, Home Depot--featured in our weekly after they have been "hacked" by a cyber attack. The last week or so has featured daily revelations about shoddy cyber security and other practices at the entertainment giant. HINT: storing passwords in a file marked "passwords" is never a good idea. And, it may be wise to ensure your systems are thoroughly locked down before you make a movie featuring an assassination plot against DPRK leader-- and noted film buff Kim Jong Un. However, our models were down on Sony long before the latest hacking incident came to light. We continue our STRONG SELL recommendation on SONY CORP ADR for 2014-12-04. Based on the information we have gathered and our resulting research, we feel that SONY CORP ADR has the probability to UNDERPERFORM average market performance for the next year. The company exhibits UNATTRACTIVE P/E Ratio and Sharpe Ratio. Below is today's data on SNE:

As a bonus to our Newsletter readers, Read our Complete Detailed Valuation Report on Sony HERE.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Ticker |

Name |

Mkt Price |

Valuation(%) |

Last 12-M Retn(%) |

ERJ |

EMBRAER AIR-ADR |

35.62 |

-3.06 |

20.75 |

ATK |

ALLIANT TECHSYS |

110.36 |

-18.63 |

-6.87 |

HII |

HUNTINGTON INGL |

107.53 |

2.61 |

29.91 |

WAIR |

WESCO AIRCRAFT |

13.99 |

-27.2 |

-31.05 |

SPR |

SPIRIT AEROSYS |

43.5 |

9.05 |

37.48 |

Top-Five Aerospace Stocks--Long-Term Forecast Returns

Ticker |

Name |

Mkt Price |

Valuation(%) |

Last 12-M Retn(%) |

ERJ |

EMBRAER AIR-ADR |

35.62 |

-3.06 |

20.75 |

ATK |

ALLIANT TECHSYS |

110.36 |

-18.63 |

-6.87 |

HII |

HUNTINGTON INGL |

107.53 |

2.61 |

29.91 |

WAIR |

WESCO AIRCRAFT |

13.99 |

-27.2 |

-31.05 |

SPR |

SPIRIT AEROSYS |

43.5 |

9.05 |

37.48 |

Top-Five Aerospace Stocks--Composite Score

Ticker |

Name |

Mkt Price |

Valuation(%) |

Last 12-M Retn(%) |

ERJ |

EMBRAER AIR-ADR |

35.62 |

-3.06 |

20.75 |

HII |

HUNTINGTON INGL |

107.53 |

2.61 |

29.91 |

SPR |

SPIRIT AEROSYS |

43.5 |

9.05 |

37.48 |

ATK |

ALLIANT TECHSYS |

110.36 |

-18.63 |

-6.87 |

BA |

BOEING CO |

131.32 |

-4.6 |

-0.14 |

Top-Five Aerospace Stocks--Most Overvalued

Ticker |

Name |

Mkt Price |

Valuation(%) |

Last 12-M Retn(%) |

GD |

GENL DYNAMICS |

144.88 |

54.39 |

61.91 |

LLL |

L-3 COMM HLDGS |

123.52 |

51.09 |

21.6 |

XLS |

EXELIS INC |

17.57 |

36.21 |

1.68 |

LDOS |

LEIDOS HOLDINGS |

43.08 |

33.78 |

3.98 |

NOC |

NORTHROP GRUMMN |

139.84 |

33.4 |

26.56 |

Find out what Wall Street Investment and Media Professionals already know,

ValuEngine offers sophisticated stock valuation and forecast research as well as a variety of portfolio screening and creation tools.

If you are reading this you should sign up for ValuEngine's award-winning stock valuation and forecast service

NO OBLIGATION, 30 DAY FREE TRIAL!To Sign Up for a FREE TRIAL, Please Click HERE

What's Hot--

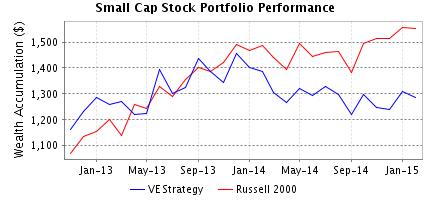

--ValuEngine Small Cap Stock Newsletter Posts 6% Gain

The ValuEngine Small Cap Stock Newsletter features 15 primary stock selection and five alternate stock picks derived from our award-winning stock forecast model. Equities selected focus on small-cap companies which can be more voaltile, but also offer the potential of outsized returns for a given amount of investment capital.

For October/November, the stock market continued its renewed rally. Our small cap stock newsletter also laid in a strong gain as investors began to pick up this equity class again. We had a great gain of 6.22% overall but couldn't quite match the SP500 pick up of 7.26%. We trailed by 104 bps. The trailing 12 month gain of the Small Cap Stock Strategy is -6.47% versus the S&P 500 return of 16.04%. The return since inception is 29.58% versus the S&P's gain of 49.04%.

We had nine out of 15 winners this month, with some massive pickups courtesy of Tower Semiconductors (44.66%) and Inteliquent (40.17%). We also garnered double-digit pick ups from Tower International, DTS Inc., Ultra Clean Holdings, and Pacific Ethanol. Unfortunately our few losers tended to post double-digit losses, so we were held back from truly outstanding performance by Star Bulk Carriers, Arotech, Valco Enbergy, and HCI Group. We also bemoan the fact that we had an alternate that was NOT included in the main portfolio. Ani Pharma had a huge gain of 97.57%.

With the ValuEngine Small Cap Stock Newsletter you Receive 20 Carefully Selected Stock Picks

Representing the Most Up-to-Date Calculations of our Award-Winning Stock Forecast Model

CLICK HERE TO SUBSCRIBE NOW

Here are the latest results from October/November 2014:

Ticker |

Company Name |

Entry Price 10/22/14 |

Exit Price |

Change |

%Change |

ARTX |

AROTECH CORP |

2.76 |

2.28 |

-0.48 |

-17.39 |

AXAS |

ABRAXAS PETROLEUM |

3.92 |

4.21 |

0.29 |

7.40 |

DHT |

DHT HOLDINGS |

5.99 |

6.32 |

0.33 |

5.51 |

DTSI |

DTS INC |

28 |

32.16 |

4.16 |

14.86 |

EGY |

VAALCO ENERGY |

7.67 |

6.56 |

-1.11 |

-14.47 |

FSI |

FLEXIBLE SOLUTIONS |

1.17 |

1.15 |

-0.02 |

-1.71 |

HCI |

HCI GROUP INC |

48.21 |

41.93 |

-6.28 |

-13.03 |

IQNT |

INTELIQUENT INC |

13.07 |

18.32 |

5.25 |

40.17 |

PEIX |

PACIFIC ETHANOL INC |

12.33 |

13.9 |

1.57 |

12.73 |

RIOM |

RIO ALTO MINING |

2.41 |

2.62 |

0.21 |

8.71 |

SBLK |

STAR BULK CARRIERS |

10.61 |

8.4 |

-2.21 |

-20.83 |

TOWR |

TOWER INTERNATIONAL |

22.27 |

25.67 |

3.4 |

15.27 |

TSEM |

TOWER SEMICONDUCTORS |

8.89 |

12.86 |

3.97 |

44.66 |

UCTT |

ULTRA CLEAN HOLDINGS |

7.67 |

8.7 |

1.03 |

13.43 |

ZAGG |

ZAGG INC |

5.84 |

5.72 |

-0.12 |

-2.05 |

VE SMALL CAP PORTFOLIO |

6.22 |

||||

GSPC |

S&P500 |

1927.11 |

2067.03 |

139.92 |

7.26 |

Our Investment Strategies Focus on Dozens of Fundamental and Technical Factors for over 7,000 Individual Stocks, Synthesize the Data, and then Come Up with a Portfolio

For the ValuEngine Small Cap Stock Newsletter, companies with a market cap greater than @ $500 million are eliminated from the selection basket. Stocks trading at less than $1.00/share are also eliminated. This typically leaves @700-1300 equities eligible for inclusion in the portfolio each month. Stock selections are further refined by applying the VE Forecast Model one-year return calculations to rank stocks according to the highest return forecasts. The final portfolio is then selected based on the one-month return forecast of the remaining stock basket. Portfolio size is limited to 15 stocks. No diversity requirements are applied. An equal amount of capital was allocated to all stocks.

CLICK HERE to Subscribe to the ValuEngine Small Cap Stock Newsletter

Small cap stocks allow investors to establish larger positions on a share basis and thus benefit from the price swings and upward volatility of these sorts of equities. Small cap stocks often lead rallies. However, this volatility and risk runs both ways. So, prudent investors are careful to establish stop-losses and hedging strategies for every portfolio.

If you no longer wish to receive this free newsletter, CLICK HERE to unsubscribe