January 21, 2015

ATTENTION

Advanced Investors and Finance Professionals:

If you are reading this you should download ValuEngine

Institutional Software to see how VE’s powerful quantitative

tools can increase your productivity and effectiveness. |

VALUATION WATCH: Undervalued stocks now make up 57% of our universe and 23.71% of the universe is calculated to be overvalued by 20% or more. 15 of 16 sectors are calculated to be overvalued--14 of them by double digits.

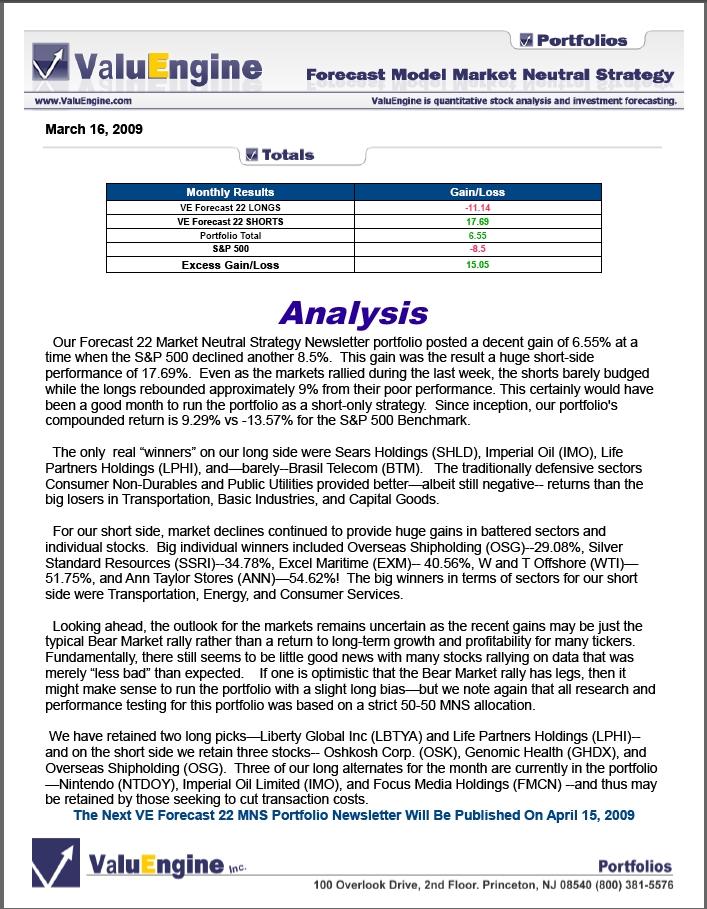

VE Forecast 16 Market Neutral Newsletter Posts 12% Gain for Month

Our portfolio posted a massive gain of 12.54% this month. We beat the benchmark MLSAX's* pick up of 5.09% by 745 bps. The modified stop-lossed strategy with a suggested 60-40 allocation gained 14.26%. The trailing 12 month percentage return is -10.92% for the newsletter and 5.99% for the MLSAX Long-Short Fund. Since inception, our portfolio has returned 86.49% vs the MLSAX return of 29.54%.

*NOTE: We have begun to use the MLSAX Long-Short Fund as a benchmark. This compares the performance of our strategy to other similar strategies.

Record levels for indices create problems for a strategy with a long AND short side, and we certainly saw that for much of 2014. But recent volatility and market change allowed our MNS to shine. Longs were incredible this month with thirteen winners—six double-digit with Sibanye posting a mammoth 59% gain. Shorts included a 59% pick up of their own thanks to Ehealth, and featured three other double-digit gainers. Let's hope this trend continues so we can return to our winning ways.

Due to the ongoing market turmoil and volatility—and the big decline in Energy stocks, undervalued stocks outnumber overvalued according to our valuation model. 57.21% of the stocks we can assign a valuation are calculated to be undervalued-- with 23.71% of them calculated to be undervalued by 20% or more. We remain bullish on US equities, but the unsettled energy market and Euro-zone uncertainties are having a negative effect on stocks despite the more positive recent economic data within the US.

Here are the primary long and short-side selections and their performance for the month.

Position |

Ticker |

Company Name |

|

Exit Price |

Change |

%Change |

Sector |

Long 1 |

ATK |

ALLIANT TECHSYS |

101.76 |

124.52 |

22.76 |

22.37 |

AEROSPACE |

Long 1 |

TOWR |

TOWER INTL INC |

22.67 |

22.48 |

-0.19 |

-0.84 |

AUTO TIRES TRUCKS |

Long 1 |

SBGL |

SIBANYE GLD-ADR |

6.9 |

11 |

4.1 |

59.42 |

BASIC MATERIALS |

Long 1 |

BBSI |

BARRETT BUS SVS |

25.77 |

32.28 |

6.51 |

25.26 |

BUSINESS SERVICES |

Long 1 |

ARRS |

ARRIS GROUP INC |

27.4 |

27.86 |

0.46 |

1.68 |

COMPUTERS TECHNOLOGY |

Long 1 |

LEN |

LENNAR CORP -A |

41.32 |

42.33 |

1.01 |

2.44 |

CONSTRUCTION |

Long 1 |

PRSC |

PROVIDENCE SVC |

36.05 |

37.03 |

0.98 |

2.72 |

CONSUMER DISCRETIONARY |

Long 1 |

SAFM |

SANDERSON FARMS |

86.49 |

82.42 |

-4.07 |

-4.71 |

CONSUMER STAPLES |

Long 1 |

CYS |

CYS INVESTMENTS |

8.79 |

8.89 |

0.1 |

1.14 |

FINANCE |

Long 1 |

UEPS |

NET 1 UEPS TECH |

10.52 |

11.97 |

1.45 |

13.78 |

INDUSTRIAL PRODUCTS |

Long 1 |

LCI |

LANNETT INC |

42.7 |

46.37 |

3.67 |

8.59 |

MEDICAL |

Long 1 |

FSS |

FED SIGNAL CP |

14.52 |

15.33 |

0.81 |

5.58 |

MULTI-SECTOR CONGLOM |

Long 1 |

EMES |

EMERGE ENRG SVC |

45.21 |

59.42 |

14.21 |

31.43 |

OILS ENERGY |

Long 1 |

FLWS |

1800FLOWERS.COM |

7.37 |

7.44 |

0.07 |

0.95 |

RETAIL WHOLESALE |

Long 1 |

GBX |

GREENBRIER COS |

42.93 |

49.97 |

7.04 |

16.4 |

TRANSPORTATION |

Long 1 |

TEF |

TELEFONICA S.A. |

14.77 |

14.31 |

-0.46 |

-3.11 |

UTILITIES |

Short 1 |

KTOS |

KRATOS DEFENSE |

4.28 |

4.87 |

-0.59 |

-13.79 |

AEROSPACE |

Short 1 |

FSYS |

FUEL SYSTEM SOL |

10.19 |

10.89 |

-0.7 |

-6.87 |

AUTO TIRES TRUCKS |

Short 1 |

SCHN |

SCHNITZER STEEL |

22.04 |

16.94 |

5.1 |

23.14 |

BASIC MATERIALS |

Short 1 |

XOOM |

XOOM CORP |

14.45 |

15.6 |

-1.15 |

-7.96 |

BUSINESS SERVICES |

Short 1 |

RST |

ROSETTA STONE |

10.24 |

9.17 |

1.07 |

10.45 |

COMPUTERS TECHNOLOGY |

Short 1 |

FIX |

COMFORT SYSTEMS |

15.76 |

15.87 |

-0.11 |

-0.7 |

CONSTRUCTION |

Short 1 |

LF |

LEAPFROG ENTRPS |

4.62 |

3.95 |

0.67 |

14.5 |

CONSUMER DISCRETIONARY |

Short 1 |

RDEN |

ELIZABETH ARDEN |

17.95 |

17.72 |

0.23 |

1.28 |

CONSUMER STAPLES |

Short 1 |

EHTH |

EHEALTH INC |

26.3 |

10.7 |

15.6 |

59.32 |

FINANCE |

Short 1 |

MYE |

MYERS INDS |

15.91 |

16.47 |

-0.56 |

-3.52 |

INDUSTRIAL PRODUCTS |

Short 1 |

CLDX |

CELLDEX THERAPT |

16.84 |

21.69 |

-4.85 |

-28.8 |

MEDICAL |

Short 1 |

MIC |

MACQUARIE INFRA |

64.45 |

70.5 |

-6.05 |

-9.39 |

MULTI-SECTOR CONGLOM |

Short 1 |

POWR |

POWERSECURE INT |

10.27 |

10.25 |

0.02 |

0.19 |

OILS ENERGY |

Short 1 |

AMZN |

AMAZON.COM INC |

295.06 |

289.44 |

5.62 |

1.9 |

RETAIL WHOLESALE |

Short 1 |

SKYW |

SKYWEST INC |

10.77 |

12.79 |

-2.02 |

-18.76 |

TRANSPORTATION |

Short 1 |

TDS |

TELEPHONE &DATA |

23.15 |

23.97 |

-0.82 |

-3.54 |

UTILITIES |

|

|

PORTFOLIO TOTAL |

|

|

|

|

|

|

GSPC |

S&P500 |

1685.39 |

1687.99 |

2.60 |

2.52 |

|

|

|

LONG PORTFOLIO |

|

|

|

|

|

|

|

SHORT PORTFOLIO |

|

|

|

|

|

Why Subscribe to The ValuEngine Forecast 16 Market Neutral Strategy Newsletter? |

The ValuEngine Forecast 16 Market Neutral Strategy Newsletter is based on one of our most tested and researched portfolio strategies. It uses our Forecast Model to provide the same sort of long-short equity portfolio utilized by major hedge funds and institutions without the hefty management and performance fees.

|

Each month you will receive an electronic copy of our newsletter highlighting 16 potential long and short positions along with 16 alternate picks per side. Each of our 16 sectors will include 2 stocks so that you can construct a diverse portfolio that minimizes risk and maximizes returns. We carefully examine dozens of fundamental and technical factors for over 5,500 individual stocks, synthesize the data, and then come up with a sector-diverse list of our best and worst forecast 1-month return stocks.Each portfolio pick includes critical ValuEngine valuation and forecast data. These 64 total picks represent the most up-to-date equity assessments of our proprietary models.

Why Market Neutral? Market neutral strategy (MNS) portfolios offer the potential of decent, steady returns in both good markets and bad. For the last three years, the ValuEngine Forecast 16 Model MNS portfolio has provided the highest returns of any of our benchmark portfolio strategies. The ValuEngine Diversified Growth 16 Market Neutral Strategy Newsletter offers the investor capable of running a short side access to increased performance with lower overall volatility and hedged risk.You can run an equally allocated MNS portfolio, or customize it to your needs by adjusting your capital allocation between the long and short sides. With the ValuEngine Diversified Growth 16 Market Neutral Strategy Newsletter, you can--essentially--run your own hedge fund! |

FIND OUT MORE HERE

ValuEngine Market Overview

Summary of VE Stock Universe |

Stocks Undervalued |

57.21% |

Stocks Overvalued |

42.79% |

Stocks Undervalued by 20% |

23.71% |

Stocks Overvalued by 20% |

12.96% |

ValuEngine Sector Overview

|

|

|

|

|

|

|

|

0.27% |

-1.34% |

-1.34% |

11.09% overvalued |

-4.85% |

20.40 |

|

-0.52% |

1.09% |

1.09% |

8.95% overvalued |

1.32% |

30.45 |

|

-0.80% |

-2.69% |

-2.69% |

6.93% overvalued |

1.99% |

26.95 |

|

-0.17% |

-0.38% |

-0.38% |

6.06% overvalued |

4.03% |

24.87 |

|

0.02% |

-1.35% |

-1.35% |

4.38% overvalued |

9.40% |

22.31 |

|

-0.05% |

-2.31% |

-1.01% |

1.32% overvalued |

-5.25% |

30.41 |

|

-0.61% |

-2.99% |

-2.99% |

0.64% overvalued |

-4.83% |

26.27 |

|

-0.10% |

-1.62% |

-1.62% |

0.42% overvalued |

1.43% |

20.45 |

|

-0.50% |

-2.56% |

-2.56% |

1.16% undervalued |

2.12% |

17.62 |

|

-0.23% |

-1.99% |

-1.99% |

1.27% undervalued |

0.35% |

24.70 |

|

-0.07% |

-2.35% |

-2.35% |

5.86% undervalued |

-0.37% |

19.50 |

|

-0.10% |

-3.80% |

-3.80% |

9.63% undervalued |

-11.43% |

19.45 |

|

-0.27% |

-2.97% |

-2.97% |

10.13% undervalued |

-6.22% |

14.92 |

|

-0.83% |

-4.22% |

-4.22% |

11.23% undervalued |

-5.56% |

23.71 |

|

0.16% |

0.06% |

0.04% |

11.70% undervalued |

-15.65% |

23.36 |

|

-1.27% |

-7.18% |

-7.18% |

24.42% undervalued |

-31.51% |

19.34 |

ValuEngine.com Products and Services

With the ValuEngine Forecast 16 Market Neutral Strategy Portfolio Newsletter, you can run your own portfolio like a hedge fund to manage risk and profit in any market environment. |

|

|

With ValuEngine.com's Premium Website Membership you get forecasts, valuations, and recommendations on more than 8,000 stocks updated every trading day!

NO OBLIGATION, 30-DAY FREE TRIAL! |

|

|

|