January 29, 2015

VALUATION WATCH: Overvalued stocks now make up 57.72% of our stocks assigned a valuation and 12.78% of those equities are calculated to be overvalued by 20% or more. Eight sectors are calculated to be overvalued--with three at or near double digits. We are the Champions, AGAIN

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

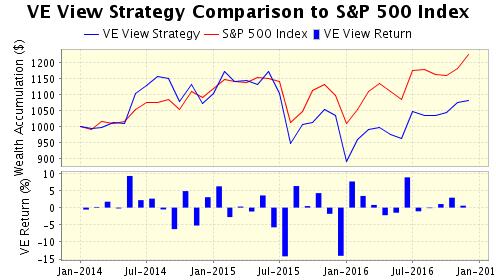

VE View vs. S&P 500 Index Past Five Years |

||

VE View |

S&P 500 |

|

|---|---|---|

Ann Return |

24.78% | 14.56% |

Ann Volatility |

22.28% | 12.35% |

Sharpe Ratio |

1.11 | 1.18 |

Sortino Ratio |

1.88 | 1.53 |

Max Drawdown |

-34.94% | -11.14% |

The ValuEngine View Newsletter is derived from the ValuEngine Aggressive and Diversified Growth Benchmark Portfolio Strategies. These strategies are the product of ValuEngine's academic research team and combine cutting-edge financial analysis and portfolio construction techniques with real-world Wall St. know how.

Portfolio Strategies. These strategies are the product of ValuEngine's academic research team and combine cutting-edge financial analysis and portfolio construction techniques with real-world Wall St. know how.

CLICK HERE to Subscribe to the ValuEngine View

The ValuEngine View Newsletter portfolio has 15 primary stock picks and five alternates and is re-balanced once each month. The ValuEngine View Newsletter is published near the middle of each calendar month. An equal amount of capital is allocated to each stock. The monthly returns are calculated from the closing prices on date of publication. The performance calculation does not include any transaction costs.

ValuEngine Market Overview

Summary of VE Stock Universe |

|

Stocks Undervalued |

57.72% |

Stocks Overvalued |

42.28% |

Stocks Undervalued by 20% |

24.13% |

Stocks Overvalued by 20% |

12.78% |

ValuEngine Sector Overview

Sector

|

Change

|

MTD

|

YTD

|

Valuation

|

Last 12-MReturn

|

P/E Ratio

|

-0.69% |

0.65% |

0.65% |

13.34% overvalued |

1.34% |

20.78 |

|

-1.11% |

1.08% |

1.08% |

10.82% overvalued |

6.23% |

31.17 |

|

-1.00% |

-2.74% |

-2.74% |

9.78% overvalued |

6.36% |

27.58 |

|

-1.05% |

0.24% |

0.24% |

7.14% overvalued |

7.23% |

24.84 |

|

-1.48% |

-1.16% |

-1.16% |

5.39% overvalued |

12.36% |

21.76 |

|

-0.78% |

-1.81% |

-0.51% |

2.65% overvalued |

-1.64% |

30.53 |

|

-0.91% |

0.18% |

0.18% |

2.44% overvalued |

5.30% |

20.98 |

|

-0.99% |

-2.53% |

-2.53% |

1.65% overvalued |

-2.93% |

26.37 |

|

-1.12% |

-2.39% |

-2.39% |

0.99% undervalued |

5.02% |

17.56 |

|

-0.95% |

-1.80% |

-1.80% |

1.02% undervalued |

2.58% |

24.81 |

|

-1.81% |

-2.31% |

-2.31% |

4.42% undervalued |

7.70% |

20.48 |

|

-0.64% |

-1.00% |

-1.00% |

8.57% undervalued |

-1.15% |

15.20 |

|

-1.23% |

-3.86% |

-3.86% |

8.61% undervalued |

-8.29% |

19.62 |

|

-1.13% |

-0.73% |

-0.75% |

8.88% undervalued |

-16.14% |

24.02 |

|

-1.06% |

-3.46% |

-3.46% |

9.33% undervalued |

-2.86% |

24.19 |

|

-3.72% |

-5.85% |

-5.85% |

21.45% undervalued |

-29.44% |

19.74 |

ValuEngine.com Products and Services