September 11, 2017For today's bulletin, we take a look at two of our home improvement retailers in the wake of Hurricanes Irma and Harvey. We also provide a link to download FREE STOCK REPORTS on Lowe's $LOW and Home Depot $HD. VALUATION: Overvalued

stocks now make up 49.72% of our stocks assigned a valuation and 18.12% of

those equities are calculated to be overvalued by 20% or more.

Ten sectors are calculated to be overvalued. --Stay Safe

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ValuEngine Forecast |

||

Target Price* |

Expected Return |

|

|---|---|---|

1-Month |

159.96 | 0.19% |

3-Month |

159.35 | -0.20% |

6-Month |

161.27 | 1.01% |

1-Year |

163.31 | 2.29% |

2-Year |

160.48 | 0.51% |

3-Year |

156.20 | -2.17% |

Valuation & Rankings |

|||

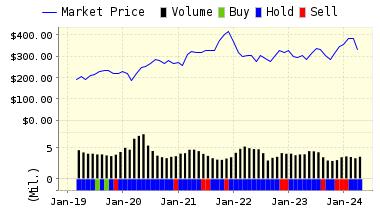

Valuation |

2.73% overvalued |

Valuation Rank(?) |

|

1-M Forecast Return |

0.19% |

1-M Forecast Return Rank |

|

12-M Return |

21.64% |

Momentum Rank(?) |

|

Sharpe Ratio |

1.26 |

Sharpe Ratio Rank(?) |

|

5-Y Avg Annual Return |

19.42% |

5-Y Avg Annual Rtn Rank |

|

Volatility |

15.42% |

Volatility Rank(?) |

|

Expected EPS Growth |

11.48% |

EPS Growth Rank(?) |

|

Market Cap (billions) |

210.40 |

Size Rank |

|

Trailing P/E Ratio |

22.72 |

Trailing P/E Rank(?) |

|

Forward P/E Ratio |

20.38 |

Forward P/E Ratio Rank |

|

PEG Ratio |

1.98 |

PEG Ratio Rank |

|

Price/Sales |

2.16 |

Price/Sales Rank(?) |

|

Market/Book |

159.52 |

Market/Book Rank(?) |

|

Beta |

1.05 |

Beta Rank |

|

Alpha |

-0.03 |

Alpha Rank |

|

DOWNLOAD A FREE SAMPLE OF OUR HOME DEPOT (HD) REPORT BY CLICKING HERE

ValuEngine continues its HOLD recommendation on Lowe's Companies Inc. for 2017-09-08. Based on the information we have gathered and our resulting research, we feel that Lowe's Companies Inc. has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Book Market Ratio.

You can download a free copy of detailed report on Lowe's Companies Inc. (LOW) from the link below.

ValuEngine Forecast |

||

Target Price* |

Expected Return |

|

|---|---|---|

1-Month |

78.67 | 0.14% |

3-Month |

78.51 | -0.06% |

6-Month |

78.10 | -0.59% |

1-Year |

79.87 | 1.67% |

2-Year |

79.07 | 0.66% |

3-Year |

80.30 | 2.22% |

Valuation & Rankings |

|||

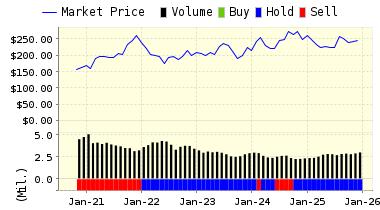

Valuation |

4.06% undervalued |

Valuation Rank(?) |

|

1-M Forecast Return |

0.14% |

1-M Forecast Return Rank |

|

12-M Return |

5.98% |

Momentum Rank(?) |

|

Sharpe Ratio |

1.02 |

Sharpe Ratio Rank(?) |

|

5-Y Avg Annual Return |

19.07% |

5-Y Avg Annual Rtn Rank |

|

Volatility |

18.65% |

Volatility Rank(?) |

|

Expected EPS Growth |

10.94% |

EPS Growth Rank(?) |

|

Market Cap (billions) |

76.43 |

Size Rank |

|

Trailing P/E Ratio |

17.91 |

Trailing P/E Rank(?) |

|

Forward P/E Ratio |

16.14 |

Forward P/E Ratio Rank |

|

PEG Ratio |

1.64 |

PEG Ratio Rank |

|

Price/Sales |

1.13 |

Price/Sales Rank(?) |

|

Market/Book |

17.85 |

Market/Book Rank(?) |

|

Beta |

1.05 |

Beta Rank |

|

Alpha |

-0.17 |

Alpha Rank |

|

DOWNLOAD A FREE SAMPLE OF OUR LOWE'S (LOW) REPORT BY CLICKING HERE

Contact ValuEngine at (800) 381-5576 or support@valuengine.com

Visit www.ValuEngine.com for more information

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information