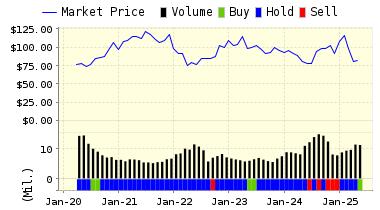

May 7, 2018For today's bulletin, we take a look at Starbucks $SBUX. We also provide a link to download a FREE STOCK REPORT on the company. NASDAQ:SBUX VALUATION WATCH: Overvalued

stocks now make up 49.1% of our stocks assigned a valuation and 17.44% of

those equities are calculated to be overvalued by 20% or more.

Ten sectors are calculated to be overvalued. --Coffee WorldwideValuEngine Rates Starbucks A SELLStarbucks Corporation (SBUX) purchases and roasts high-quality whole bean coffees and sells them along with fresh, rich-brewed, Italian style espresso beverages, a variety of pastries and confections, and coffee-related equipments primarily through its company-operated retail stores. In addition to sales through its company-operated retail stores, Starbucks sells whole bean coffees through a specialty sales group and supermarkets. Additionally, Starbucks produces and sells bottled Frappuccino coffee drink and a line of premium ice creams through its joint venture partnerships and offers a line of innovative premium teas produced by its wholly owned subsidiary, Tazo Tea Company. The company's objective is to establish Starbucks as the most recognized and respected brand in the world. Want to learn more about ValuEngine? Our methods? Our history?

The sale will provide Starbucks with a big cash infusion, and that cash may help investors. Starbucks intends to use the after-tax proceeds from this up-front payment primarily to accelerate share buybacks and now expects to return approximately $20 billion in cash to shareholders in the form of share buybacks and dividends through fiscal year 2020. Additionally, the transaction is expected to be earnings per share (EPS) accretive by the end of fiscal year 2021 or sooner, with no change to the company’s currently stated long-term financial targets.

DOWNLOAD A FREE SAMPLE OF OUR STARBUCKS (SBUX) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (800) 381-5576 or support@valuengine.com Visit www.ValuEngine.com for more information ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine's award-winning stock research. Contact ValuEngine Capital at info@valuenginecapital.com Visit www.ValuEngineCapital.com for more information Steve Hach |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||