May 14, 2018For today's bulletin, we take a look at ArcBest Corporation $ARCB. We also provide a link to download a FREE STOCK REPORT on the company. VALUATION WATCH: Overvalued

stocks now make up 52.67% of our stocks assigned a valuation and 19.87% of

those equities are calculated to be overvalued by 20% or more.

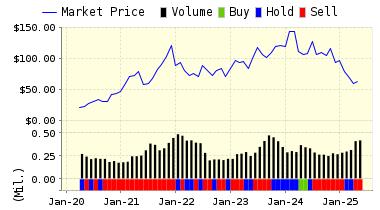

Eleven sectors are calculated to be overvalued. --King of the RoadValuEngine Upgrades Trucking Firm ArcBest to STRONG BUYArcBest Corporation (ARCB) provides freight transportation services and solutions. The company's Freight Transportation segment offers transportation of general commodities; motor carrier freight transportation services; business-to-business air transportation services; ocean transport services; global customizable supply chain solutions and integrated warehousing services. Its Premium Logistics & Expedited Freight Services segment provides expedited freight transportation services to commercial and government customers; premium logistics services; and domestic and international freight transportation with air, ocean, and ground service. ArcBest Corporation, formerly known as Arkansas Best Corporation, is headquartered in Fort Smith, Arkansas. Want to learn more about ValuEngine? Our methods? Our history? ArcBest has been upgraded by our models to STRONG BUY. The stock has put in a nice leg up thanks to some very strong earnings results. Analysts expected a loss of $0.07/share and when the company reported last week they posted earnings of $0.37/share. That's a huge beat. Sales expectations were also exceeded handily, with the company reporting sales of $700 million vs. the expected sale for Q1 of $690.4 million. “Strong market demand for our supply chain solutions and purposeful yield management contributed to our positive first quarter results,” said Chairman, President & CEO Judy McReynolds. ”We are pleased that customers are finding value in our enhanced market approach and are utilizing us as a trusted partner for more of their logistics needs.” McReynolds went on to note that

DOWNLOAD A FREE SAMPLE OF OUR ARCBEST CORP (ARCB) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (800) 381-5576 or support@valuengine.com Visit www.ValuEngine.com for more information ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine's award-winning stock research. Contact ValuEngine Capital at info@valuenginecapital.com Visit www.ValuEngineCapital.com for more information Steve Hach |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||