October 15, 2018

For today's bulletin, we take a look at the demise of Sears Holdings (SHLD).

VALUATION WATCH: Overvalued

stocks now make up 40.24% of our stocks assigned a valuation and 14.90% of

those equities are calculated to be overvalued by 20% or more. Seven sectors are calculated to be overvalued.

If you cannot display this bulletin properly, GO HERE

To subscribe to our bulletins and receive content whenever it is published, subscribe at our blog HERE

--Going, Going, GONE

American Icon Sears Run Into Ground

Sears Holdings Corporation (SHLD), the parent of Kmart and Sears, Roebuck and Co., is the leading home appliance retailer in North America and is a retail sales leader in tools, lawn and garden, home electronics, and automotive repair and maintenance. Key proprietary brands include Kenmore, Craftsman and DieHard, and a broad apparel offering, including such well-known labels as Lands' End, Jaclyn Smith and Joe Boxer, as well as the Apostrophe and Covington brands.

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

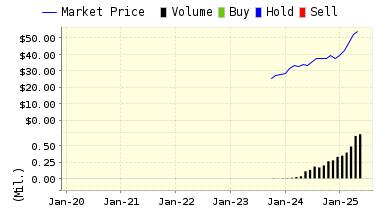

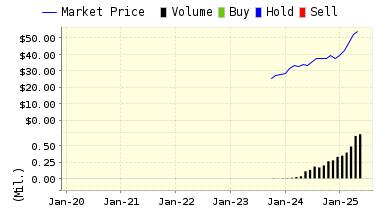

It's been a long-time coming, but what so many predicted has finally come to pass. Sears Holdings has declared bankruptcy, unable to make a big payment on its debt. This story is sad for students of American history and consumerism, as Sears Roebuck was an icon of the nation, so long an important part of culture and life.

As we have detailed many times over the past few years, Sears provides a cautionary tale about what can happen when a CEO more driven by ideology than sense gets free reign to implement ideas that may sound good after the reading of an Ayn Rand novel, but are, in fact, disastrous when trying to run a massive retail concern.

Eddie Lampert spent years demanding that divisions within the company compete for bonuses and resources in a sort of Darwinian experiment gone horribly wrong.

It took a while, but after seven years of losses and hundreds of store closings, the firm finally collapsed under the weight of Lampert's horrible leadership.

Of course, the follies of Lampert were bad, but outside events didn't help the giant retailer either. Wal-Mart dethroned Sears decades ago as the largest retail concern in the US. More recently, Amazon.com chipped away at the once storied retailer even more. A merger with K-Mart didn't help stop the bleeding either.

Now, the sad story shows that more than 200,000 jobs are lost, shareholder losses exceed $30 billion, and the numerous employees who have already retired will most likely lose their pensions.

It stands as a cautionary tale about hedge funds and their supposed genius when it comes to running businesses in which they acquire a stake--and of course, Lampert seemed to have a knack for skimming off the cream of the crop when it came time to liquidate the company's assets.

While Lampert currently claims that Sears will be back, we aren't goigng to hold our breath.

You can download a free copy of our summary report on Sears Holdings (SHLD) from the link below. As you can see, many data fields are no longer available due to the bankruptcy filing.

ValuEngine Forecast |

| |

Target

Price* |

Expected

Return |

1-Month |

0.41 |

0.00% |

3-Month |

0.41 |

0.00% |

6-Month |

0.41 |

0.00% |

1-Year |

0.41 |

0.00% |

2-Year |

0.41 |

0.00% |

3-Year |

0.41 |

0.00% |

Valuation & Rankings |

Valuation |

n/a |

|

n/a n/a |

1-M Forecast Return |

n/a |

1-M Forecast Return Rank |

n/a n/a |

12-M Return |

n/a |

|

n/a n/a |

Sharpe Ratio |

-1.32 |

|

4 4 |

5-Y Avg Annual Return |

-82.37% |

5-Y Avg Annual Rtn Rank |

6 6 |

Volatility |

62.21% |

|

25 25 |

Expected EPS Growth |

-27.56% |

|

7 7 |

Market Cap (billions) |

0.04 |

Size Rank |

23 23 |

Trailing P/E Ratio |

n/a |

|

n/a n/a |

Forward P/E Ratio |

n/a |

Forward P/E Ratio Rank |

n/a n/a |

PEG Ratio |

n/a |

PEG Ratio Rank |

n/a n/a |

Price/Sales |

0.00 |

|

100 100 |

Market/Book |

n/a |

|

n/a n/a |

Beta |

0.24 |

Beta Rank |

69 69 |

Alpha |

n/a |

Alpha Rank |

n/a n/a |

DOWNLOAD A FREE SAMPLE OF OUR SEARS HOLDINGS (SHLD) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (321) 325-0519 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine's award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.Com |