January 9, 2019

VALUATION WATCH: Overvalued

stocks now make up 25.45% of our stocks assigned a valuation and 9.54% of

those equities are calculated to be overvalued by 20% or more.

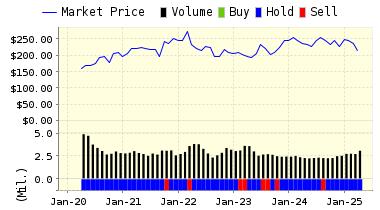

One sector is calculated to be overvalued (barely). --UPGRADESUnion Pacific Railroad is Upgraded to BUY by ValuEngineFor today's edition of our upgrade list, we used our website's advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. There were no STRONG BUY upgrades. Today, every component of our top-five list is a BUY upgrade.

Want to learn more about ValuEngine? Our methods? Our history? Union Pacific Corporation (UNP) is one of America's leading transportation companies. Its principal operating company, Union Pacific Railroad, is North America's premier railroad franchise, covering 23 states across the western two-thirds of the United States. One of America's most recognized companies, Union Pacific Railroad proves a critical link in the global supply chain. Union Pacific's network and operations is to support America's transportation infrastructure. The railroad's diversified business mix is classified into its Agricultural Products, Energy, Industrial and Premium business groups. Union Pacific serves many of the fastest-growing U.S. population centers, operates from all major West Coast and Gulf Coast ports to eastern gateways, connects with Canada's rail systems and is the only railroad serving all six major Mexico gateways. Union Pacific provides value to its customers by delivering products in a safe, reliable, fuel-efficient and environmentally responsible manner.

DOWNLOAD A FREE SAMPLE OF OUR UNION PACIFIC (UNP) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (321) 325-0519 or support@valuengine.com Visit www.ValuEngine.com for more information ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine's award-winning stock research. Contact ValuEngine Capital at info@valuenginecapital.com Visit www.ValuEngineCapital.com for more information Steve Hach |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||