August 31, 2016

VALUATION WATCH: Overvalued stocks now make up 47.98% of our stocks assigned a valuation and 15.65% of those equities are calculated to be overvalued by 20% or more. Nine sectors are calculated to be overvalued.

If you cannot display this bulletin properly, GO HERE

Taxing Situation

Apple Hit With Massive Tax Bill By EU Regulators

EU regulators have dropped a bomb on Apple this week with a demand that the company pay Ireland more than $14 billion in back taxes covering the period of 2003-2014. The company did not technically evade these payments, they had an agreement with the government of Ireland to avoid them as part of a deal to base the company in that country. EU rules forbid member states from providing such tax breaks to corporations.

Apple had a real sweet-heart deal with Ireland. The tech darling managed to pay miniscule annual tax rates which varied between 0.0005-1% for the period covered by the agreements. EU anti-trust official Margrethe Vestager noted that "The commission’s investigation concluded that Ireland granted illegal tax benefits to Apple, which enabled it to pay substantially less tax than other businesses over many years."

This back tax penalty is the largest ever levied by the EU and it has ramifications for many big firms that have used tactics such as "inversion" and other loopholes to move to EU member states and avoid taxation. While the actual payment will probably be held up in court for years, it will surely put many big corporations on notice that their efforts to avoid paying the tax man may come back to bite them in the long-term.

Of course, the massive $14 billion back tax payment sounds substantive, but the reality is that Apple is highly profitable in Europe and in the most recent quarter alone their profits were almost $8 billion. But, the company plans to fight this tax bill and in the meantime will place the money demanded by the EU into an escrow account.

Apple Inc. (AAPL) is engaged in designing, manufacturing and marketing mobile communication and media devices, personal computers, and portable digital music players. The Company's products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and Mac OS X operating systems, iCloud, and a range of accessory, service and support offerings. It sells its products worldwide through its online stores, its retail stores, its direct sales force, third-party wholesalers, and resellers. Apple Inc. is headquartered in Cupertino, California.

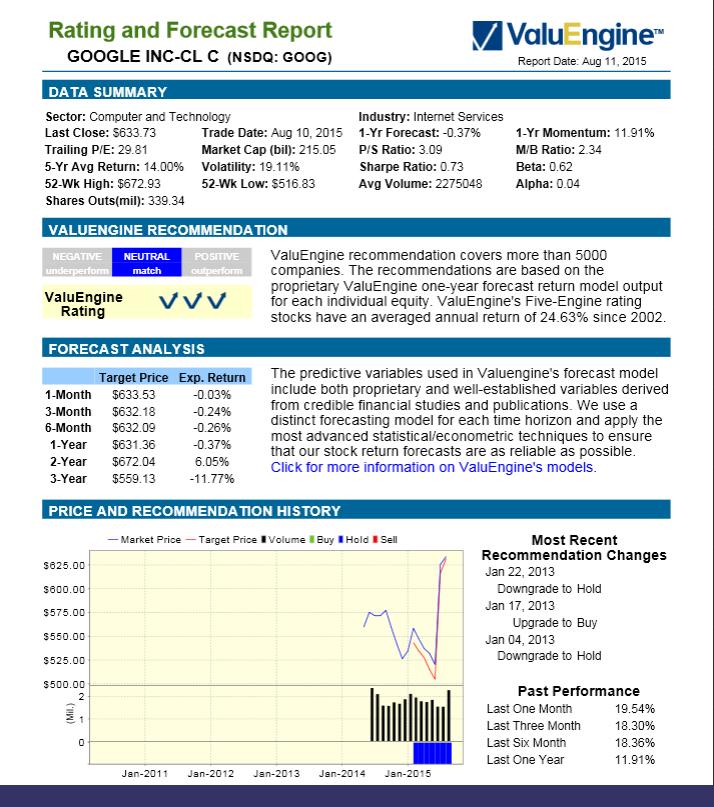

ValuEngine continues its HOLD recommendation on APPLE INC for 2016-08-30. Based on the information we have gathered and our resulting research, we feel that APPLE INC has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Book Market Ratio.

You can download a free copy of detailed report on Apple Inc. (AAPL) from the link below.

ValuEngine Forecast |

| |

Target

Price* |

Expected

Return |

1-Month |

105.91 |

-0.09% |

3-Month |

107.07 |

1.01% |

6-Month |

108.48 |

2.34% |

1-Year |

104.89 |

-1.05% |

2-Year |

121.66 |

14.77% |

3-Year |

118.89 |

12.16% |

Valuation & Rankings |

Valuation |

0.92% overvalued |

|

47 47 |

1-M Forecast Return |

-0.09% |

1-M Forecast Return Rank |

44 44 |

12-M Return |

-6.00% |

|

36 36 |

Sharpe Ratio |

0.49 |

|

82 82 |

5-Y Avg Annual Return |

12.50% |

5-Y Avg Annual Rtn Rank |

83 83 |

Volatility |

25.66% |

|

65 65 |

Expected EPS Growth |

1.06% |

|

26 26 |

Market Cap (billions) |

617.42 |

Size Rank |

100 100 |

Trailing P/E Ratio |

12.54 |

|

84 84 |

Forward P/E Ratio |

12.41 |

Forward P/E Ratio Rank |

72 72 |

PEG Ratio |

11.78 |

PEG Ratio Rank |

4 4 |

Price/Sales |

2.80 |

|

35 35 |

Market/Book |

5.24 |

|

25 25 |

Beta |

1.07 |

Beta Rank |

42 42 |

Alpha |

-0.19 |

Alpha Rank |

29 29 |

DOWNLOAD A FREE SAMPLE OF OUR APPLE (AAPL) REPORT BY CLICKING HERE

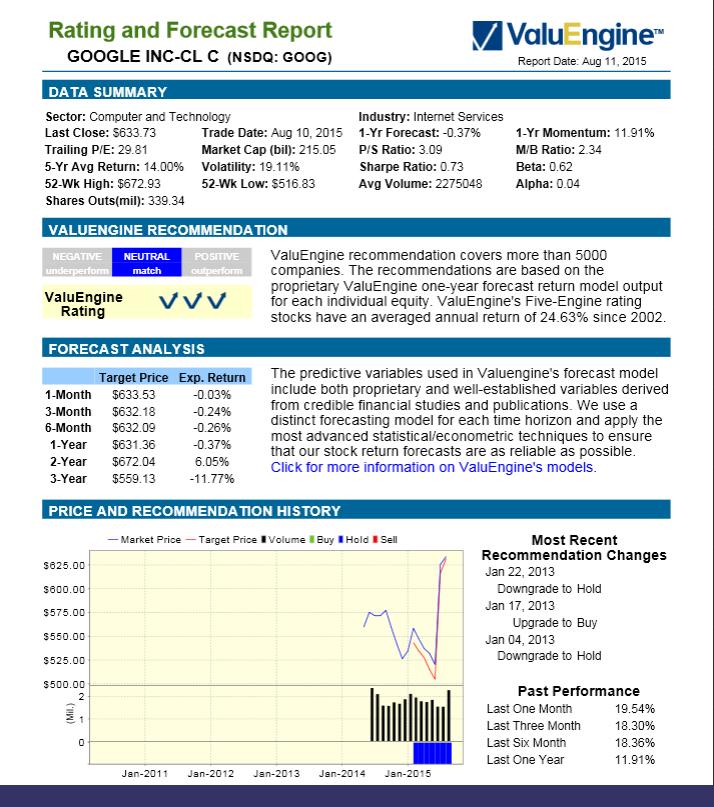

ValuEngine Market Overview

Summary of VE Stock Universe |

Stocks Undervalued |

52.02% |

Stocks Overvalued |

47.98% |

Stocks Undervalued by 20% |

21.82% |

Stocks Overvalued by 20% |

15.65% |

ValuEngine Sector Overview

|

|

|

|

|

|

|

|

0.03% |

2.04% |

9.54% |

12.48% overvalued |

5.55% |

20.80 |

|

-0.52% |

1.23% |

10.41% |

9.69% overvalued |

13.02% |

23.95 |

|

-0.31% |

3.08% |

16.36% |

7.60% overvalued |

8.91% |

23.21 |

|

-0.99% |

-0.91% |

45.22% |

4.93% overvalued |

53.25% |

32.09 |

|

-0.22% |

1.23% |

0.60% |

2.74% overvalued |

0.87% |

19.39 |

|

0.04% |

3.50% |

15.39% |

2.50% overvalued |

8.73% |

29.00 |

|

-0.41% |

-2.67% |

10.90% |

1.33% overvalued |

13.67% |

21.97 |

|

0.38% |

2.82% |

7.32% |

0.94% overvalued |

5.03% |

16.31 |

|

-0.26% |

2.76% |

16.31% |

0.91% overvalued |

-9.69% |

25.40 |

|

0.43% |

1.31% |

30.61% |

0.54% undervalued |

13.75% |

21.46 |

|

0.49% |

0.23% |

11.20% |

1.60% undervalued |

-14.41% |

14.68 |

|

0.01% |

1.58% |

9.05% |

1.76% undervalued |

0.05% |

24.16 |

|

0.35% |

1.54% |

9.35% |

5.11% undervalued |

2.30% |

24.86 |

|

0.34% |

2.17% |

4.84% |

7.81% undervalued |

3.73% |

16.58 |

|

-0.32% |

1.64% |

2.11% |

9.49% undervalued |

-3.52% |

23.21 |

|

0.04% |

-0.59% |

0.66% |

10.12% undervalued |

-13.35% |

27.73 |

ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, target price, and valuations on over 7,000 US and Canadian equities every trading day.

Visit www.ValuEngine.com for more information

|