May 17, 2017For today's bulletin, we take a look at our latest upgrades and focus on retail giant The Gap $GPS and provide a link to download a FREE STOCK REPORT on the company VALUATION WATCH: Overvalued stocks now make up 62.33% of our stocks assigned a valuation and 26.25% of those equities are calculated to be overvalued by 20% or more. Fourteen sectors are calculated to be overvalued. --Upgrades

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Ticker |

Company Name |

Market Price |

Valuation |

Last 12-M Return |

1-M Forecast Return |

1-Yr Forecast Return |

P/E Ratio |

Sector Name |

GPS |

GAP INC |

24.59 |

-17.69% |

40.11% |

1.18% |

14.19% |

12.30 |

Retail-Wholesale |

BOOT |

BOOT BARN HLDGS |

8.95 |

-27.10% |

36.85% |

1.09% |

13.05% |

14.51 |

Retail-Wholesale |

TLRD |

TAILORED BRANDS |

11.77 |

-39.25% |

-8.69% |

1.08% |

13.03% |

7.01 |

Retail-Wholesale |

SASR |

SANDY SPRING |

39.47 |

5.77% |

41.57% |

0.52% |

6.28% |

17.73 |

Finance |

NOBGD |

NOBLE GROUP LTD |

6.5 |

N/A |

42.86% |

0.97% |

11.63% |

8.28 |

Multi-Sector Conglomerates |

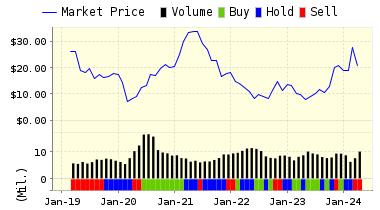

The Gap, Inc. (GPS) is a global specialty retailer which operates stores selling casual apparel, personal care and other accessories for men, women and children under the Gap, Banana Republic and Old Navy brands. The company designs virtually all of its products, which in turn are manufactured by independent sources, and sells them under its brand names.

The stock continues to be a favorite of our models and has now been upgraded to STRONG BUY. This comes on the heels of an upgrade to BUY back in April.

As we have noted a lot of late, retailers like the Gap have been beat up over the past few years by the "Amazon effect" as more shoppers avoid malls and such and do their shopping from the comfort and convenience of their homes.

At least for today, we see that our models sense value and a buying opportunity here. Three out of our top-five upgrades today are from that battered sector. This wouldn't be unprecedented, the news about Target (TGT) has been bad lately, but they posted a decent

earnings--of the not as bad as expected category, and their shares have surged today.

The Gap reports tomorrow, and we will see if they can repeat the path demonstrated by Target with their latest earnings. Look for numbers that are "less bad" --or in other ways show that the company is turning around and weathering the retail storm successfully. Critical for their results will be the performance of Old Navy as that brand, with its lower prices, has been the star as the more expensive stores--like Banana Republic--founder.

VALUENGINE RECOMMENDATION: ValuEngine updated its recommendation from BUY to STRONG BUY for GAP INC on 2017-05-16. Based on the information we have gathered and our resulting research, we feel that GAP INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and P/E Ratio.

Below is today's data on The Gap, Inc. (GPS):

ValuEngine Forecast |

||

Target Price* |

Expected Return |

|

|---|---|---|

1-Month |

24.88 | 1.18% |

3-Month |

24.39 | -0.83% |

6-Month |

24.46 | -0.52% |

1-Year |

28.08 | 14.19% |

2-Year |

22.47 | -8.62% |

3-Year |

20.99 | -14.65% |

Valuation & Rankings |

|||

Valuation |

17.69% undervalued |

Valuation Rank(?) |

|

1-M Forecast Return |

1.18% |

1-M Forecast Return Rank |

|

12-M Return |

40.11% |

Momentum Rank(?) |

|

Sharpe Ratio |

-0.05 |

Sharpe Ratio Rank(?) |

|

5-Y Avg Annual Return |

-1.68% |

5-Y Avg Annual Rtn Rank |

|

Volatility |

33.48% |

Volatility Rank(?) |

|

Expected EPS Growth |

10.62% |

EPS Growth Rank(?) |

|

Market Cap (billions) |

10.42 |

Size Rank |

|

Trailing P/E Ratio |

12.30 |

Trailing P/E Rank(?) |

|

Forward P/E Ratio |

11.11 |

Forward P/E Ratio Rank |

|

PEG Ratio |

1.16 |

PEG Ratio Rank |

|

Price/Sales |

0.67 |

Price/Sales Rank(?) |

|

Market/Book |

3.59 |

Market/Book Rank(?) |

|

Beta |

0.90 |

Beta Rank |

|

Alpha |

-0.01 |

Alpha Rank |

|

DOWNLOAD A FREE SAMPLE OF OUR THE GAP (GPS) REPORT BY CLICKING HERE

Contact ValuEngine at (800) 381-5576 or support@valuengine.com

Visit www.ValuEngine.com for more information

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information