January 14, 2019For today's bulletin, we take a look at Citigroup $C and provide a link to download a copy of our latest stock report on the banking giant. VALUATION WATCH: Overvalued

stocks now make up 27.72% of our stocks assigned a valuation and 10.13% of

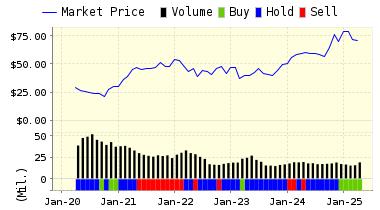

those equities are calculated to be overvalued by 20% or more. One sector is calculated to be overvalued. --Back In BlackCitigroup Posts ResultsCitigroup Inc. (C) is a global financial services company. It provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services and wealth management. The Company also offers various wholesale banking products and services, including fixed income and equity sales and trading, foreign exchange, prime brokerage, and equity and fixed income research services. Citigroup Inc. is based in New York. Want to learn more about ValuEngine? Our methods? Our history? Citigroup reported results today and while they were better than last year, there were still some troubling signs at the banking giant. Citigroup reported net income for the fourth quarter 2018 of $4.3 billion, or $1.64 per diluted share, on revenues of $17.1 billion. This compared to a net loss of $18.9 billion, or $7.38 per diluted share, on revenues of $17.5 billion for the fourth quarter 2017. Excluding the one-time impact of Tax Reform in both the current and the prior-year periods, net income of $4.2 billion increased 14%, primarily driven by a reduction in expenses, lower cost of credit and a lower effective tax rate, partially offset by lower revenues. On this basis, earnings per share of $1.61 increased 26% from $1.28 per diluted share in the prior-year period, driven by the growth in net income and an 8% reduction in average diluted shares outstanding. For the full year 2018, Citigroup reported net income of $18.0 billion on revenues of $72.9 billion, compared to a net loss of $6.8 billion on revenues of $72.4 billion for the full year 2017. Excluding the one-time impact of Tax Reform, Citigroup net income of $18.0 billion increased 14% compared to the prior year.

DOWNLOAD A FREE SAMPLE OF OUR CITIGROUP (C) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (321) 325-0519 or support@valuengine.com Visit www.ValuEngine.com for more information ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine's award-winning stock research. Contact ValuEngine Capital at info@valuenginecapital.com Visit www.ValuEngineCapital.com for more information Steve Hach |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||