November 21, 2014

Valuation WATCH: Overvalued stocks now make up 61.31% of our stocks assigned a valuation and 22.17% of those equities are calculated to be overvalued by 20% or more. Fourteen sectors are calculated to be overvalued--with six sectors at or near double digits.

ValuEngine Index Overview

ValuEngine Market Overview

ValuEngine Sector Overview

ValuEngine Newsletters Latest Results

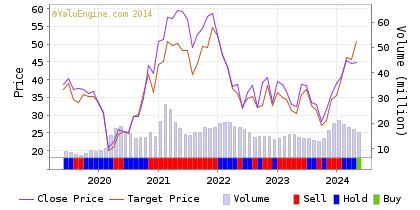

ValuEngine's Newsletters Beat the Market Let ValuEngine Optimize your Portfolio and Provide Rational Advice for Smarter Investing Click HERE to Check Out ValuEngine's Investment Newsletters Free Download for ReadersAs a bonus to our Free Weekly Newsletter subscribers, General Motors Company (GM) is engaged in the designing, manufacturing and retailing of vehicles globally including passenger cars, crossover vehicles, and light trucks, sport utility vehicles, vans and other vehicles. Its business is organized into three geographically-based segments- General Motors North America (GMNA), General Motors International Operations (GMIO) and General Motors Europe (GME). General Motors Company is headquartered in Detroit, Michigan, the United States of America. ValuEngine continues its BUY recommendation on GENERAL MOTORS for 2014-11-20. Based on the information we have gathered and our resulting research, we feel that GENERAL MOTORS has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Price Sales Ratio. Below is today's data on GM:

As a bonus to our Newsletter readers, Read our Complete Detailed Valuation Report on GM HERE.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Ticker |

Name |

Mkt Price |

Valuation(%) |

Last 12-M Retn(%) |

SBS |

SABESP -ADR |

7.81 |

-24.3 |

-29.58 |

BT |

BT GRP PLC-ADR |

58.99 |

-8.78 |

-2.27 |

BIP |

BROOKFIELD INFR |

41.97 |

-1.46 |

4.53 |

SCG |

SCANA CORP |

56.31 |

1.79 |

20.01 |

TI |

TELECOM ITA-ADR |

11.21 |

N/A |

24.42 |

Top-Five Utilities Stocks--Long-Term Forecast Returns

Ticker |

Name |

Mkt Price |

Valuation(%) |

Last 12-M Retn(%) |

SBS |

SABESP -ADR |

7.81 |

-24.3 |

-29.58 |

BT |

BT GRP PLC-ADR |

58.99 |

-8.78 |

-2.27 |

BIP |

BROOKFIELD INFR |

41.97 |

-1.46 |

4.53 |

SCG |

SCANA CORP |

56.31 |

1.79 |

20.01 |

TI |

TELECOM ITA-ADR |

11.21 |

N/A |

24.42 |

Top-Five Utilities Stocks--Composite Score

Ticker |

Name |

Mkt Price |

Valuation(%) |

Last 12-M Retn(%) |

BT |

BT GRP PLC-ADR |

58.99 |

-8.78 |

-2.27 |

SCG |

SCANA CORP |

56.31 |

1.79 |

20.01 |

SBS |

SABESP -ADR |

7.81 |

-24.3 |

-29.58 |

BIP |

BROOKFIELD INFR |

41.97 |

-1.46 |

4.53 |

T |

AT&T INC |

35.28 |

-3.36 |

-0.34 |

Top-Five Utilities Stocks--Most Overvalued

Ticker |

Name |

Mkt Price |

Valuation(%) |

Last 12-M Retn(%) |

TWTC |

TW TELECOM INC |

42.78 |

67.79 |

52.62 |

SRE |

SEMPRA ENERGY |

110.26 |

40.46 |

23.44 |

CNSL |

CONSOL COMM IL |

26.38 |

33.15 |

39.43 |

TEG |

INTEGRYS ENERGY |

73.13 |

30.15 |

29.89 |

FTR |

FRONTIER COMMUN |

7 |

28.89 |

44.63 |

Find out what Wall Street Investment and Media Professionals already know,

ValuEngine offers sophisticated stock valuation and forecast research as well as a variety of portfolio screening and creation tools.

If you are reading this you should sign up for ValuEngine's award-winning stock valuation and forecast service

NO OBLIGATION, 30 DAY FREE TRIAL!To Sign Up for a FREE TRIAL, Please Click HERE

What's Hot--

-- VE View Finishes Strong Again

We have seen fears of Ebola, ISIS, and other issues fade “magically” with the latest election. We find that the environment for equities remains positive and economic data continues to improve. Clearly, much of the doom and gloom back in mid-October had more to do with political arguments and electoral concerns than raw data.

For October/November, the stock market returned to its winning ways and once more set or flirted with all-time highs. Our long-only ValuEngine View posted a gain of 4.81% vs the S&P500 gain of 5.53%. We trailed the index, but still consider this a great month as our newsletter shook off the recent market hiccup and powered up once again. The trailing 12 month gain of the VE View is 18.51% versus the S&P 500 return of 14.59%. The return since inception of the View is 125.1% versus the S&P's gain of 80.91%.

Here are the latest VE View Newsletter Portfolio Results:

| Ticker | Company Name | Entry Price 10/22/14 | Exit Price | Change | %Change |

AER |

AERCAP HOLDINGS |

40.38 |

43.38 |

3 |

7.43 |

AFSI |

AMTRUST FINANCIAL SERVICES |

49.95 |

51.3 |

1.35 |

2.7 |

ATK |

ALLIANT TECHSYSTEMS |

130.06 |

113.49 |

-16.19 |

-12.48 |

AUO |

AU OPTRONICS-ADR |

4 |

4.69 |

0.69 |

17.25 |

BT |

BT GROUP PLC-ADR |

59.92 |

59.89 |

-0.03 |

-0.05 |

GMT |

GATX CORP |

58.32 |

63.97 |

5.65 |

9.69 |

GPRE |

GREEN PLAINS |

31.91 |

34.15 |

2.24 |

7.02 |

HII |

HUNTINGTON INGALLS |

96.84 |

109.08 |

12.24 |

12.64 |

LCI |

LANNETT INC |

44.96 |

46.84 |

1.88 |

4.18 |

LYB |

LYONDELLBASEL-A |

95.19 |

89.35 |

-5.84 |

-6.14 |

MU |

MICRON TECHNOLOGY |

31.19 |

32.96 |

1.77 |

5.67 |

ONNN |

ON SEMICONDUCTOR CORP |

7.79 |

8.46 |

0.67 |

8.6 |

PJC |

PIPER JAFFRAY |

48.78 |

56.22 |

7.44 |

15.25 |

SAFM |

SANDERSON FARMS |

80.89 |

89.11 |

8.22 |

10.16 |

WLK |

WESTLAKE CHEMICAL |

76.79 |

69.32 |

-7.47 |

-9.73 |

| VE VIEW PORTFOLIO | 4.81 |

||||

| GSPC | S&P500 | 1941.28 |

2048.72 |

107.44 |

5.53 |

Want To Know More About Our VE View Newsletter?

The ValuEngine View Newsletter is the product of a sophisticated stock valuation model that was first developed by ValuEngine's academic research team. It utilizes a three factor approach: fundamental variables such as a company's trailing 12-month Earnings-Per-Share (EPS), the analyst consensus estimate of the company's future 12-month EPS, and the 30-year Treasury yield are all used to create a more accurate reflection of a company's fair value. A total of eleven additional firm specific variables are also used. In addition, the portoflio uses top picks from our Forecast Model. In essence, the portfolio is constructed with the best picks from our main propiretary models

Each month you will receive an electronic copy of our newsletter highlighting 15 potential long positions along with five alternate picks. Our investment strategies focus on dozens of fundamental and technical factors for over 8000 individual stocks, synthesize the data, and then come up with a portfolio. Each newsletter portfolio focuses on maximum potential returns so there are no diversity requirements. Each portfolio pick includes critical ValuEngine valuation and forecast data. These 20 total picks represent the most up-to-date equity assessments of our proprietary models.

Please click HERE to subscribe. You may download a sample copy HERE. After your subscription is approved, you will immediately receive access to download the current issue of newsletter as well as the previous issues, which are all available as PDF files. Each month when the latest issue of the newsletter is released, we will send you an email, informing you to download it from the site. The newsletter is released near the middle of each month.

If you no longer wish to receive this free newsletter, CLICK HERE to unsubscribe