September 27, 2016

VALUATION WATCH: Overvalued stocks now make up 46.12% of our stocks assigned a valuation and 15.27% of those equities are calculated to be overvalued by 20% or more. Eight sectors are calculated to be overvalued.

If you cannot display this bulletin properly, GO HERE

Not Going Well(s)

Wells Fargo Faces Scrutiny Over Sales Practices

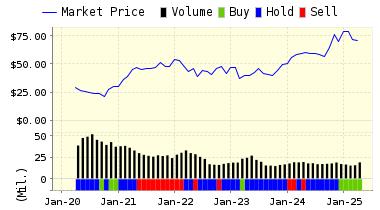

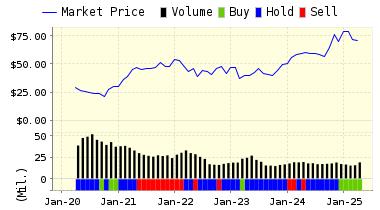

Wells Fargo & Company (WFC) is a diversified financial services company providing banking, insurance, investments, mortgage and consumer finance services through stores, its Internet site and other distribution channels across North America as well as internationally.

The banking giant is currently besieged by a scandal related to its overaggressive sales culture and practices. The bank was so demanding when it came to selling additional credit cards and services to existing clients that employees engaged in fraudulent activity in an effort to meet quotas.

Employees who failed to meet the aggressive sales quotas were criticized ion conference calls and threatened with termination. Others were actually fired for failing to meet the goals. IN some cases, employees told customers they had "new credit cards" while in others deposits were split up between different products to meet the sales quota.

The bank has been aware of these allegations for several years, and its own internal investigations indicated that there was an issue. But, the bank did little about it because they had no idea how much fraudulent activity was padding their numbers. In other words, the quotas kept escalating in response to the "fake" numbers being submitted by branches across the nation.

Once state regulators became involved, allegations of fraud were made as the bank employees had set up totally fictitious accounts and/or set up additional accounts for actual persons without their express permission. In response, the bank fired some employees and has announced that they will scrap all product-based sales goals.

However, this scandal shows no sign of going away as it was also revealed that executives running operations for the bank who have left the company were paid massive bonuses. Both CEO John Stumpf and retail-banking head Carrie Tolstedt received performance-bonuses and salary packages based in part on the fraudulent practices.

These packages--which add up to $90 million for Tolstedt and $160 million for Stumpf --have become more "problematic" as details of the scandal have emerged. Members of Congress holding hearings on this subject were particularly concerned about the big bonuses and salary packages for those at the top of the firm. Currently, the Wells Fargo board is discussing claw-back options for these packages.

Claw backs have been a concern since the aftermath of the 2008 financial crisis, when taxpayers bailed out banks while sales people and executives often kept bonuses based on the fraudulent and reckless practices which led to the crash in the first place.

It remains to be seen how this scandal will effect the bank's long-term financial health. For now, the stock is down a bit (9%) since the revelations, the bank is facing a $185 million fine from the US Consumer Financial Protection Bureau, and it also faces a lawsuit from shareholders.

ValuEngine continues its HOLD recommendation on WELLS FARGO-NEW for 2016-09-26. Based on the information we have gathered and our resulting research, we feel that WELLS FARGO-NEW has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Earnings Growth Rate.

You can download a free copy of detailed report on Wells Fargo & Company (WFC) from the link below.

ValuEngine Forecast |

| |

Target

Price* |

Expected

Return |

1-Month |

44.88 |

0.00% |

3-Month |

44.84 |

-0.09% |

6-Month |

44.46 |

-0.93% |

1-Year |

44.90 |

0.04% |

2-Year |

47.06 |

4.85% |

3-Year |

37.05 |

-17.45% |

Valuation & Rankings |

Valuation |

13.87% undervalued |

|

72 72 |

1-M Forecast Return |

0.00% |

1-M Forecast Return Rank |

51 51 |

12-M Return |

-12.82% |

|

27 27 |

Sharpe Ratio |

0.95 |

|

94 94 |

5-Y Avg Annual Return |

13.32% |

5-Y Avg Annual Rtn Rank |

82 82 |

Volatility |

14.07% |

|

86 86 |

Expected EPS Growth |

0.00% |

|

23 23 |

Market Cap (billions) |

232.82 |

Size Rank |

100 100 |

Trailing P/E Ratio |

11.05 |

|

88 88 |

Forward P/E Ratio |

11.05 |

Forward P/E Ratio Rank |

78 78 |

PEG Ratio |

941,202.00 |

PEG Ratio Rank |

1 1 |

Price/Sales |

2.51 |

|

38 38 |

Market/Book |

1.42 |

|

65 65 |

Beta |

0.91 |

Beta Rank |

50 50 |

Alpha |

-0.14 |

Alpha Rank |

34 34 |

DOWNLOAD A FREE SAMPLE OF OUR WELLS FARGO (WFC) REPORT BY CLICKING HERE

ValuEngine Market Overview

Summary of VE Stock Universe |

Stocks Undervalued |

53.88% |

Stocks Overvalued |

46.12% |

Stocks Undervalued by 20% |

21.89% |

Stocks Overvalued by 20% |

15.27% |

ValuEngine Sector Overview

|

|

|

|

|

|

|

|

-0.78% |

-1.65% |

6.52% |

15.29% overvalued |

4.07% |

20.00 |

|

-0.35% |

1.14% |

17.12% |

4.43% overvalued |

14.25% |

23.13 |

|

-0.92% |

1.16% |

16.70% |

4.24% overvalued |

12.15% |

29.45 |

|

-0.99% |

1.11% |

11.68% |

3.70% overvalued |

18.79% |

22.29 |

|

-0.86% |

0.31% |

45.47% |

2.50% overvalued |

63.34% |

30.92 |

|

-0.69% |

-0.17% |

10.50% |

2.41% overvalued |

14.49% |

24.24 |

|

-0.45% |

-0.42% |

28.56% |

2.13% overvalued |

-1.00% |

24.71 |

|

-1.07% |

1.45% |

2.17% |

0.81% overvalued |

8.88% |

18.22 |

|

-0.86% |

-0.14% |

7.00% |

0.53% undervalued |

6.50% |

16.56 |

|

-0.90% |

-0.20% |

13.66% |

1.43% undervalued |

0.08% |

24.62 |

|

-1.10% |

0.63% |

9.01% |

1.75% undervalued |

3.64% |

23.90 |

|

-0.87% |

2.61% |

2.23% |

4.11% undervalued |

-8.03% |

27.12 |

|

-0.29% |

-0.28% |

31.05% |

5.04% undervalued |

15.11% |

20.13 |

|

-1.31% |

0.40% |

5.26% |

6.36% undervalued |

11.31% |

13.60 |

|

-0.81% |

-0.74% |

10.89% |

7.06% undervalued |

-11.50% |

14.97 |

|

-1.91% |

-1.44% |

0.65% |

8.69% undervalued |

-1.07% |

22.13 |

ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, target price, and valuations on over 7,000 US and Canadian equities every trading day.

Visit www.ValuEngine.com for more information

|