January 22, 2016

If the tables, charts, or other content in this email version of the newsletter do not display properly, please download the HTML version from

ValuEngine.com HERE |

VALUATION WATCH: Overvalued stocks now make up 22.65% of our stocks assigned a valuation and 6.89% of those equities are calculated to be overvalued by 20% or more. Zero sectors are calculated to be overvalued.

ValuEngine Index Overview

|

|

|

|

|

|

DJIA |

16009.45 |

16072.5 |

63.05 |

0.39% |

-9.82% |

NASDAQ |

4548.05 |

4575.79 |

27.74 |

0.61% |

-3.19% |

RUSSELL 2000 |

1010.3 |

1015.28 |

4.98 |

0.49% |

-15.72% |

S&P 500 |

1888.66 |

1904.25 |

15.59 |

0.83% |

-7.51% |

ValuEngine Market Overview

Summary of VE Stock Universe |

Stocks Undervalued |

77.35% |

Stocks Overvalued |

22.65% |

Stocks Undervalued by 20% |

43.59% |

Stocks Overvalued by 20% |

6.89% |

ValuEngine Sector Overview

Sector Talk--Consumer Staples

Below, we present the latest data on Consumer Staples stocks from our Professional Stock Analysis Service Top five lists are provided for each category. We applied some basic liquidity criteria--share price greater than $3 and average daily volume in excess of 100k shares.

Top-Five Consumer Staples Stocks--Short-Term Forecast Returns

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

CALM |

CAL-MAINE FOODS |

48.91 |

7.05% |

34.85% |

OME |

OMEGA PROTEIN |

20.12 |

-13.99% |

82.74% |

CSV |

CARRIAGE SVCS-A |

22.05 |

-15.10% |

4.75% |

HELE |

HELEN OF TROY |

85.57 |

-3.05% |

14.34% |

RAI |

REYNOLDS AMER |

45.7 |

-34.25% |

32.91% |

Top-Five Consumer Staples Stocks--Long-Term Forecast Returns

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

CALM |

CAL-MAINE FOODS |

48.91 |

7.05% |

34.85% |

OME |

OMEGA PROTEIN |

20.12 |

-13.99% |

82.74% |

CSV |

CARRIAGE SVCS-A |

22.05 |

-15.10% |

4.75% |

HELE |

HELEN OF TROY |

85.57 |

-3.05% |

14.34% |

RAI |

REYNOLDS AMER |

45.7 |

-34.25% |

32.91% |

Top-Five Consumer Staples Stocks--Composite Score

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

RAI |

REYNOLDS AMER |

45.7 |

-34.25% |

32.91% |

CALM |

CAL-MAINE FOODS |

48.91 |

7.05% |

34.85% |

OME |

OMEGA PROTEIN |

20.12 |

-13.99% |

82.74% |

TSN |

TYSON FOODS A |

51.01 |

10.95% |

25.30% |

HELE |

HELEN OF TROY |

85.57 |

-3.05% |

14.34% |

Top-Five Consumer Staples Stocks--Most Overvalued

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

PRMW |

PRIMO WATER CP |

8.09 |

60.89% |

99.51% |

TAP |

MOLSON COORS-B |

86.57 |

49.53% |

12.93% |

LANC |

LANCASTER COLON |

116.83 |

33.16% |

25.65% |

STZ |

CONSTELLATN BRD |

143.45 |

25.51% |

29.78% |

CLX |

CLOROX CO |

125.89 |

25.31% |

15.69% |

Free Download for Readers

As a bonus to our Free Weekly Newsletter subscribers,

we are offering a FREE DOWNLOAD of one of our Stock Reports

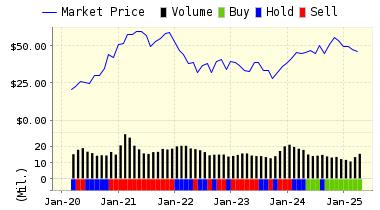

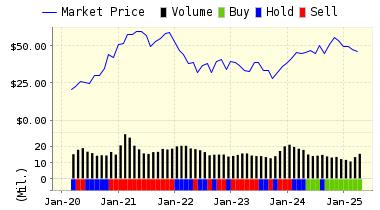

General Motors Company (GM) is engaged in the designing, manufacturing and retailing of vehicles globally including passenger cars, crossover vehicles, and light trucks, sport utility vehicles, vans and other vehicles. Its business is organized into three geographically-based segments- General Motors North America (GMNA), General Motors International Operations (GMIO) and General Motors Europe (GME). General Motors Company is headquartered in Detroit, Michigan, the United States of America.

ValuEngine continues its BUY recommendation on GENERAL MOTORS for 2016-01-21. Based on the information we have gathered and our resulting research, we feel that GENERAL MOTORS has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and P/E Ratio.

Read our Complete Detailed Valuation Report on GM HERE.

ValuEngine Forecast |

| |

Target

Price* |

Expected

Return |

1-Month |

29.83 |

0.96% |

3-Month |

30.32 |

2.62% |

6-Month |

30.32 |

2.61% |

1-Year |

32.94 |

11.48% |

2-Year |

30.05 |

1.69% |

3-Year |

29.88 |

1.12% |

Valuation & Rankings |

Valuation |

26.02% undervalued |

Valuation Rank(?) |

66 |

1-M Forecast Return |

0.96% |

1-M Forecast Return Rank |

97 |

12-M Return |

-12.81% |

Momentum Rank(?) |

57 |

Sharpe Ratio |

-0.05 |

Sharpe Ratio Rank(?) |

51 |

5-Y Avg Annual Return |

-1.61% |

5-Y Avg Annual Rtn Rank |

51 |

Volatility |

29.35% |

Volatility Rank(?) |

57 |

Expected EPS Growth |

12.40% |

EPS Growth Rank(?) |

47 |

Market Cap (billions) |

47.48 |

Size Rank |

99 |

Trailing P/E Ratio |

6.11 |

Trailing P/E Rank(?) |

95 |

Forward P/E Ratio |

5.43 |

Forward P/E Ratio Rank |

93 |

PEG Ratio |

0.49 |

PEG Ratio Rank |

57 |

Price/Sales |

0.31 |

Price/Sales Rank(?) |

85 |

Market/Book |

1.63 |

Market/Book Rank(?) |

51 |

Beta |

1.64 |

Beta Rank |

17 |

Alpha |

-0.01 |

Alpha Rank |

54 |

What's Hot

Valuations Dive On Market Pullback

Market volatility has returned with a vengeance so far this year. As we noted last month, we feel that the Fed move to boost rates was premature, and now that feeling has been bolstered by the reality of a global sell off driven by growth fears. We doubt that the US central bank will be raising rates again anytime soon. Oil prices are in the gutter thanks to a big over supply and lower demand. Crude has now gone lower than $30/barrel for the first time in twelve years, and investors are watching that per barrel price very carefully. Rallies in oil has led a rally for stocks so far today. Of course, other commodities are also suffering from price declines, and this adds further uncertainty about the global economy.

For 2016 so far, the stock market has gone into a tailspin driven by a Chinese stock-market sell off and economic slow down, carnage in the oil markets, and the resultant uncertainty about the global economy. Currently, the Valuation Model finds that 22.65% of the equities to which we can assign a valuation are overvalued--with 6.89% coming in overvalued at 20% or more. Zero sectors are calculated to be overvalued. According to these valuations, stocks are now “cheap” and we have not seen levels this low since June 2012.--when the S&P 500 was at 1285.

Of course, there is no guarantee that the current slide is over, but bargain hunting is appropriate if you find companies at attractive levels-- and you want them for the long haul.

ValuEngine Capital Is Now Autotrading Our Strategies

We are pleased to announce that ValuEngine Capital has begun trading for our clients. ValuEngine Capital, a registered investment advisory firm, offers our clients investment-management services based on industry-leading ValuEngine research. ValuEngine Capital melds the cutting-edge financial theory of ValuEngine's award-winning quantitative independent research with the best real-world Wall St. practices. ValuEngine Capital offers refined investment portfolios for investors of all risk-reward profiles.

ValuEngine Capital is offering two investment strategies to clients, the ValuEngine View Strategy and the ValuEngine Market Neutral Strategy.

ValuEngine View Strategy: The ValuEngine View Strategy is the product of a sophisticated stock valuation model that was first developed by ValuEngine's academic research team. It utilizes a three factor approach: fundamental variables such as a company's trailing 12-month Earnings-Per-Share (EPS), the analyst consensus estimate of the company's future 12-month EPS, and the 30-year Treasury yield are all used to create a more accurate reflection of a company's fair value. A total of eleven additional firm specific variables are also used. The ValuEngine View portfolio is constructed by integrating both our Aggressive Growth—based on the Valuation Model--and Diversified Growth—based on the Forecast Model-- Portfolio Strategies.

The ValuEngine View Strategy is constructed by integrating this model along with some basic rules for market capitalization and industry diversification. The portfolio has 15 stocks and is rebalanced once each month. Automatically Trade Our Portfolio Strategies ValuEngine Market Neutral Strategy: The ValuEngine Market Neutral Strategy is the product of ValuEngine's Forecast Model. This model was developed by a team of PhD's and is based on the cutting edge economic theories of Wall Street professionals and Ivy League academics. We carefully examine dozens of fundamental and technical factors for over 8,000 individual stocks, synthesize the data, and then come up with a sector-diverse list of our best and worst forecast 1-month return stocks. Short and long-term historic factors in the VE Forecast model's calculation include past-valuation levels of the stock and its recent price-momentum factor relative to other stocks. The ValuEngine Market Neutral Strategy utilizes Forecast Model outputs along with market capitalization, price, and sector diversification rules to construct a monthly portfolio made up of 16 stocks for both the long and short sides.

For more information, please contact us by email at info@ValuEngineCapital.com or by phone at (407) 308-5686.

--AAII Computerized Investing Selects ValuEngine.com "Best of the Web"

The American Association of Individual Investors (AAII) was founded in 1978 by Dr. James Cloonan. Its purpose is to distill current financial theory and academic knowledge in a manner which allows its members to beat the market. In short, AAII's philosophy and membership base is a perfect match for ValuEngine's various newsletters, website services, and other products.

ValuEngine clients access proprietary stock valuation data on more than 4000 US equities in addition to forecast and ratings for more than 8000 stocks. They can also purchase ready-made portfolios based on all of our data which are designed to fit a variety of investment styles and risk/reward profiles.

ValuEngine is always searching for self-directed investors who recognize the value of our services--just like the members of AAII, and for that reason we are proud to announce that we were recently selected one of AAII Computerized Investing's "Best of the Web" services. AAII puts Valuengine.com within the "top 16 sites for consensus analyst estimates, ratings and recommendations, stock screening, and stock valuation.

AAII officials specifically praised ValuEngine for its unique analysis of individual stocks and the wide range of information we provide. It is important to note that in an era of free content, apps, and services, ValuEngine has almost always been the only fee-based service to win a stock valuation award from AAII. We have won this award numerous times and AAII notes that

ValuEngine provides a wide range of services for individual investors and is an excellent source for stock valuation. It was chosen as Editor’s Choice because of its in-depth analysis and innovative valuation techniques that are not available at other sites.

ValuEngine CEO Paul Henneman has always been a strong supporter of AAII's program and services for individual investors and noted that

ValuEngine's objective, cutting-edge research provides the tools for any investor looking to reduce management fees and handle their own portfolios. Savvy individuals, Wall St. professionals, and the leaders of AAII have known for years that ValuEngine.com offers an outstanding suite of products which an help improve returns and beat the market. We also put our award-winning valuation calculations to work at our newly-formed investment advisory, ValuEngine Capital. So, we are of course pleased to be recognized by AAII for yet another year.

ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, target price, and valuations on over 7,000 US and Canadian equities every trading day.

Visit www.ValuEngine.com for more information

If you no longer wish to receive this free newsletter, CLICK HERE to unsubscribe

|